So now you've moved into your 40s, maybe even your 50s. During your younger years I'm sure you heard all the negative silliness about aging but now that you're middle aged, you'll realise you're in the prime of your life. You feel confident, ambitious and capable. You are at the height of your money earning power, so you can pay off more debt now than at any other time. Decisions made in previous decades about reducing debt are now starting to pay off and you can see the light at the end of the tunnel. Hopefully, with a bit of hard work and determination, you'll pay off your mortgage now and keep putting something aside for your retirement. Try your best to pay off your mortgage before you retire. And again, do not add to your debt burden. Less is best.

FUNDING YOUR RETIREMENT

If you're working, it is a wise step to put money aside all through your working life for your retirement. In Australia, this is called superannuation and the government adds 9% of every employee's annual earnings to their superannuation fund. Most employees earning over $450 a week must put a certain amount of money into their own fund too. They can add more if they wish and receive tax benefits for doing so. Most Western countries have some form of government assisted retirement funding.

I want to make two important points about funding your retirement:

- You do not need as much as most investment brokers say you need. For example, Hanno and I live well on less than $25,000 a year.

- Make sure you keep all you superannuation/retirement funding in one account. As you move from job to job throughout your working life, make sure you have the details of your chosen superannuation/retirement account to give to your new employer each time you change jobs. If you let them put your contributions into the account they usually use, you'll end up fragmenting your investment. The more money you have in one account, the more likely you'll receive a good return on the investments made on your behalf with that money. If you've got money in several accounts right now, I encourage you to take some time in the next few weeks to contact those companies with the details of where your funds should be and instruct them to transfer them over. There may be a fee for doing that, find out what the fee is before you do it, but in the long run, you'll get a better return if you're funds are in one account. That is why it's important to give your information to each new employer you have over the years - you'll avoid paying transfer fees.

TEACH YOUR CHILDREN WELL

Children need to be taught life skills all through their lives, and now, in their teens and 20s, is no exception. Of course, you'll hit a brick wall if you've never tried to provide this type of parenting before - this is a life long style of parenting, starting when they were toddlers. Now you're at the pointy end, now you have to reinforce what you've been teaching them all their lives, now it really counts. As in previous stages you make sure you are a good role model for them and always be the kind of person you want them to be. Now you teach them about being a good and fair employee, you talk to them about how to treat their friends and acquaintance with respect, and above all, you help them develop self respect and confidence.

There are also the practical skills like driving, shopping for groceries, cooking, looking after their own clothes - how to wash and iron them, and saving. Even if you've encouraged saving and focused on money management before, now is the time to reinforce all that again because there will be a lot of peer pressure to spend, spend, spend. This is the most difficult time for a parent, but it's also the most rewarding. If you can set your children out into the world, fully equipped with the life skills they need, as well as the formal education of schooling - in whatever form that took in your family, you will have given your children their very best chance of a happy and successful life.

GROW INTO YOUR LIFE

As you age you'll realise that you don't have to please everyone around you. You mature, and part of that maturity is to make yourself content. This is the time of life when the children have grown out of their very dependent stage and with that, you get more time to yourself. It's not as freeing as when they leave home, but at this stage you get an inkling of how things will be when your babies fly off and make their own lives.

Now is the time to develop your hobbies and to get enjoyment from the things you choose to do. You'll have the time now to learn new skills, develop your passion for cooking, or painting, sewing, gardening, hiking, camping, or a hundred other things you'll now have time for.

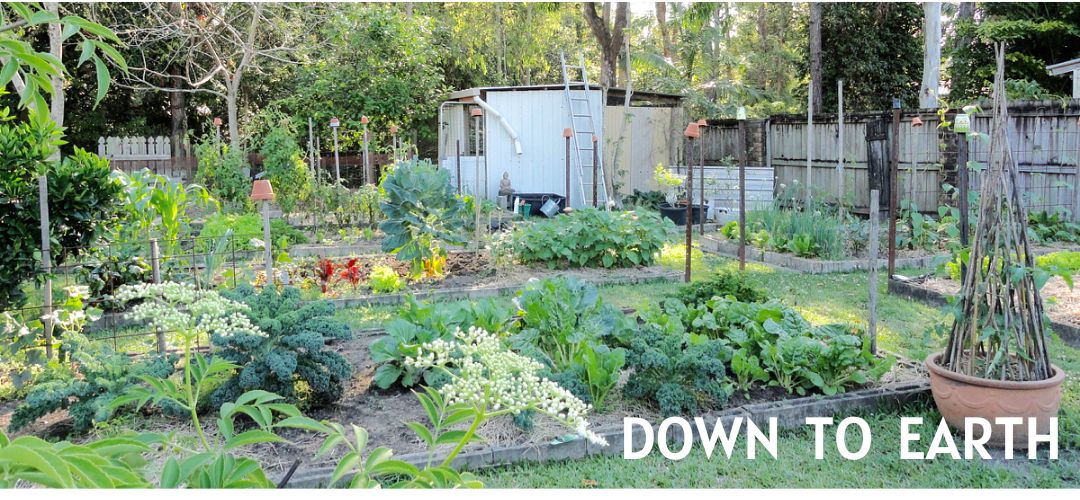

If you choose to live like Hanno and I, now is the time to develop your home and land so it can support you in later life. You might add chickens to the backyard, if you haven't already done so, you might add bee hives, aquaponics, or a couple of milking goats, and, of course, along with whatever you add, you should learn all you can about it. Do you need to add more fences? You should do that now. Whatever requires strength and energy, add it now because in your 60s, your strength will start to go and you'll wish you had thought to do it earlier.

If you're hoping to live with some degree of self sufficiency, now is the time to learn how to do everything that will help you with that aim. You'll need to learn how to bake, put up jams and preserves, mend clothes and shoes, if you're a couple, divide the chores and learning up between you both with each taking the things you enjoy doing. I like doing the inside tasks here and Hanno enjoys being outside, so he does most of the traditionally male chores like home maintenance and I am the homemaker. Now is the time to look into how you can develop your knowledge and understanding of your roles. Read - both books and blogs. I believe blogs are a wonderful way of seeing how others are living so you may pick the bits that you want to do and incorporate them into your own life.

When you're entering the final years of your fifties, and while you're still earning money, do an audit of your home. Look at your home in another way now - you want it to support you in your older years, you do not want it to be a burden. Now might be the last time you have a chance to change what you don't like and what doesn't work for you. Look at your furniture - is everything in good order? You might need to replace a few items, but do so at the thrift shop, not the department store. There are many items of old or antique furniture that may suit you that have been well made and made to last many years. Even if you have to have things recovered, revarnished or painted, you'll end up with a more sturdy and longer-lasting piece than buying furniture from China or Vietnam.

You'll realise as you get older that you need much less so now is a great time to declutter. You can give some of your odds and ends to your children as they leave home and start living their own lives, so keep a couple of boxes of the good stuff for them to use, and give away or sell what you don't need.

What you're aiming for at the end of your 50s is to have your children out in the world, working and set up in their own homes, you want to have your mortgage paid off, or almost paid off, you want your home to be supportive and comfortable and you want to know most of the things you need to help you live in that way you have chosen. If you can say you've successfully done that, then you are set for the ride of your life in your 60s for that is the time when all your work pays off. You can retire, do whatever you want to do every day, and you can live life to its fullest measure. ♥

Rhonda,

ReplyDeleteWhat a heart moving post today. I read it several times and the truth of it rings in my ears.

Hope you and Hanno are having a wonderful day.

Karyn

I'm 46 and single with 4 teenage boys. It's amazing how this post hits the nail on the head.

ReplyDeleteI recently set myself the challenge to pay off my house by the time my last son finishes year 12. (I have 1 son at uni and the rest are in secondary school. My youngest has 4.5 years to go.) It is a big task but, like you wrote, I believe that it's very important to get that mortgage yoke off our necks. My superannuation situation is shocking, (10 years out of the workforce raising preschoolers ) so I'm desperate to have the house secure for when I'm old. I call it the "Old Ladies' Nursing Home fund." My house will fund a nursing home when I'm decrepit enough to need it.

My 3rd son is very keen for us to get chickens and I was looking at your recent, very comprehensive post on chooks last night. I'm a bit scared of chooks... they look like they have really pointy beaks that I'm sure would be sharp.... but I also really like the idea of producing our own eggs. We already dabble in a veggie garden, so we're quietly going along the way to becoming more self reliant.

I liked your comments about teenagers and peer group pressure. It's been interesting to see how my boys are responding to this, as all their lives, due to my financial pressures, they've always received 'on the spot training' in how to prioritise spending/how to save/how to get the most out of a dollar. On the whole, I've been pleased with how they're going. I may not always agree with the financial decisions they make, (I'm not a Playstation gamer, for example!) but it's fascinating to see what they buy and also to listen to their reflections a few months/years down the track to hear which decisions they regret and which were ones they'd still make again.

Sorry for hijacking your comments section with what seems like a blog post. I'll go now...

Beautiful post Rhonda. I can't recall whether I've commented before, though I've been reading your blog for quite some time now :) I do love reading it - there's always some inspiration or affirmation to be found.

ReplyDeleteMandy

Hello Karyn, Frogdancer and Mandy! Frog, what a handfull you have. I wish you well with it. It sounds like you're on the right path and that your boys are doing fine. I just wanted to talk to you about chooks. They really are a wonderful addition to the backyard. If you're scared of them, look for some Pekin bantams - they are the most soft, cuddly and gentle chooks you can find. We used to have some and I remember posting a photo of Hanno hand feeding ours. Chooks do have beaks, but they're not savage. I was pecked the other day by one of our girls. I reached in under her to get an egg. She pecked me, and rightly so, how dare I be so impertinent! However, that peck, although she meant it, didn't hurt. It was really just pressure from her beak, it wasn't like a bite. I'm sure when you're used to them, you'll wonder why you went so long without them. Maybe five chooks, with #3 son looking after them, would be the way to go. He could show you how gentle they are and you can both learn about them together. :- )

ReplyDeleteHi Rhonda!

ReplyDeleteI get so much out of reading your daily posts. Your down-to-earth writing has and is making an impact on my life.

I will be 50 in August and have been dreading it, somehow its feels I am suddenly getting old, as though reaching 50 is a huge turning point in my life and not seen with any positive thoughts......but I am finding that the negatives are receeding slowly and no matter what, my birthday will arrive and I will have to get on with it!!

Thanks for the post today, as our two children grow, I hope we are teaching them well and instilling the values we think are important in life, to them. We have started cooking & baking together (for the first time a couple of weeks ago, all four of us learnt to bake a cake together which was so much fun but we had never tried before), growing our own peas, strawberries, beans & tomatoes as a first attempt this year and we started a friday family night, where we pick an activity that we can all do together as a family. Family is very important to us and our 2 are growing up so quickly, you really do have to make the most of it don't you?

My husband works hard and very long hours and hopes to change his working life sometime soon so that he can have a less stressed and tiring job and slow down a bit, I am trying to implement a lot of the ideas and tips I have picked up from your blog, as well as other reading, to simplify our lives and am now finding to my suprise that a lot of chores I never used to enjoy are seen with different eyes now. Its very much a mind thing isn't it? Slowly things are beginning to change and for the good.

Thank you Rhonda.

Hi Rhonda, this post is quite timely as my OH & I have recently sold our too large house & moving to a smaller one, although it will have more land - for chooks, vegies, etc. Also hopefully my man will finish his highly stressful job & look for something local and undemanding - we are both almost 57, in good health & on the brink of a new adventure which will include a small home based business to keep us occupied and provide a small income. We are both so excited as our moving date draws nearer. It's a good, warm feeling to think we can start living our lives the way we want to live them - simply, debt free and hopefully very little stress.

ReplyDeleteYou & Hanno are such great role models - have a great day.

I'm 55 in a few weeks Rhonda and what you say rings true. I'm still doing mental somersaults over the fact that we need to think about retirement but there it is. We have little super but are confident we can manage retirement -- I believe there is a 'consumerism cult' in a lot of retirement thinking -- you and Hanno are a fine example and we are moving towards greater self reliance. Thank you for all you do for us.

ReplyDeleteI LOVE being in my 50's ... gray hair and all:) Comfortable in my own skin. Hubby is set to retire in 20 months when the last of our mortgage is paid off. He had a practice run retiring two years ago but wasn't ready ... now he's ready as he nears 60 (at least full time work). Thanks for another great post.

ReplyDeleteSuch good advice. I'm in my early 50's and have nothing due to poor choices in earlier years. I sometimes wonder what we'll do. I'll keep reading, though and glean everything I can, as I think that by acknowledging the problem, we can begin to go a different direction. Thanks for the good content you provide.

ReplyDeleteHi Rhonda

ReplyDeleteEven though I'm in my late 30s and hubby is in his early 40s this post suits us better. We moved to the country 3 years ago and paid off our last debt, the mortgage, so now we're putting away for the future. Although it is very slow going as hubby was a student for a short time and is only now working some hours here and there. We have two lovely children who will be entering their teen years soon who we homeschool. So it's always been our way to live a simple life. I look back and wonder how we did it, but it's the small sacrifices made daily on what type of clothing or food to buy etc.

Our two challenges are money for later (we have an emergency fund that shrank during unemployment) and our climate. We live in a semi-arid area in WA where it gets extremes in Summer and Winter, so I can find almost no information on what to plant where. (we don't have a useful garden section at our hardware store, they just sell anything, whether it grows here or not.)

We do have chooks and ducks, but the ducks are gobbling the chook food so they aren't laying, we have to separate them.

I'm treating your blog like a tutorial and slowing making my way through things. Hand made bread and pickles will be my next tasks. I already crochet (my fav hobby) and have to learn some sewing to be able to quilt (always wanted to do).

Sorry to ramble, thank you for your blog, I've read it for a while now and it's always a refreshing breeze in the face after a long hot day. :o)

Thanks for this post. It is lovely. I am looking forward to this part of our lives...although it seems like we got here so fast! I told my husband about the fences...he got a heartly laugh. We have been planning some fences for years. Need to get going! Thanks.

ReplyDeleteWhat a wonderful post and full of great advice. We are planning on paying off our home, probably in about 7 years. My husband can retire in 5 years and the youngest graduates from highschool in 4 years...its gonna be an exciting 4-5 years. We are getting our first ever chickens in about 2 weeks! My extended family thinks we are crazy but thats ok! I love reading your blog!

ReplyDeleteSuch wise advice, Rhonda Jean.

ReplyDeleteWhat is that lovely pinky-cream rose next to the candle in today's illustration?

I'd love that one for my garden.

Hi, Rhonda Jean,

ReplyDeleteI must comment as your blog today really hit home. I am now in my 60's and what you have written is so very true. On a few things I am starting late with, like chickens and a couple of goats, but NOD and SIL and two grandsons will be doing the heavy stuff. I am widowed, live on a farm, and my husband was such a good money manager that everything is paid for. I will hopefully live my days on this farm with a garden, fruit trees, and the animals. My OH and I worked very hard to do just as you have written and it is a comfortable life for me. We are also training the grandsons to be self sufficient and they are loving learning it.

It is not easy to get ready for our older age, but if one puts in the work when young, believe me you will be so grateful when it does arrive!

I love your blog! Blessings!

CottonLady

As you work towards your retirement years also look at your house in another way. Keep an eye out for the electic and heating systems and if your plumbing pipes are in good order etc. If these go when you are retired you will have a harder time paying for it. If they need replacing or repairing do it early. Also if any windows need replacing or more insulation put in. I am not talking beautifying but practical measures. To know your home is snug and in good order is a wonderful feeling to bring to retirement. I understand completely the idea of doing it before 60 as we are now a bit past that and yes the energy and strength do tend to go a bit. We paid off our home many many years before retirement and have gotten many skills ready for this time in our lives. There are always more to learn though! :)

ReplyDeleteMay I add another thought on getting ready for retirement years. If you have a hobby try it out so-to-speak before retirement. If it is a hobby you want to pursue the rest of your life you may want to start gathering some of the tools for it early too. Say it is wood working or photography. Taking classes in it to make sure it is what you love. If so gather used tools as you can as it could take a while to find them.

ReplyDeleteFrom a different point of view I would like to share that sometimes things don't work out as one would like (even if we plan our life). I have enjoyed your series though, Rhonda.

ReplyDeleteFor me, I got ill in my early 30's. I did not expect this. I've not been able to work a full-time job since and can't presently work. In a perfect world, all our ducks are lined up in a row. However, I've learned that life is highly unpredictable.

If I could, I would have changed a few things. I would have saved as much as possible in my 20's in the short time I did work full-time. I would not have invested a good sum of money into one place only to lose a good chunk of it due difficult life circumstances on top of the health issues. Wisdom and hindsight are things we sometimes don't learn until it's too late.

In a nutshell I would encourage everyone to do as much as they can today, with the hopes of tomorrow, but still knowing that nothing is promised in this life.

Some of the things mentioned can no longer be dreams of mine, but that is life, and we must learn that we can't always have everything we want. Sometimes having what we need, or even less, is enough. Lyn

If I could add also - I am a little less than 50 but find that decluttering is a huge help in my life. Wish I would have done it sooner! Funny how we spend so many years gathering and collecting and then we get rid of all that stuff in our later years. It's silly, isn't it? I have found that letting go of things makes my life with illness a little bit easier. I don't want my days defined by "stuff". It's my focus this year, and I'm determined to get there! Lyn

ReplyDeleteGreat post. There is a book I love called "Work Less, Live More" that provides great guidance on ways to retire early without millions in the bank. Being debt free is absolutely key. I'm hopeful I will achieve this status (including mortgage) this year, just as I turn 40.

ReplyDeleteThank you Rhonda for those wise words! Especially regarding children in teens/twenties - I really needed to hear that. Ros

ReplyDeleteHi Rhonda, good advice to which I add this:

ReplyDelete"If you have a dollar less than you meed you are miserable. If you have a dollar more than you need you are happy, so the difference between misery and happiness is only two dollars!"

I'm 59 and it appears my retirement will come sooner than I expected. I have worked many hours the last 30 years. Now, may be the time to slow down and be at home. I am following your blog and do many of the things you suggest. Would anyone share what they do to make a little extra cash say $100. a month to help make ends meet. Thanks! And love to all who help us follow this road to self fulfillment.

ReplyDeleteGreat post Rhonda. I am in my late 60's, husband early 50's. We both still work, me part-time. Had children late, but they are now married. I quit work years ago to stay home with children. The Lord blessed us and we were able to pay off our mortgage (reasonable to begin with) on one salary. That enabled us to send our children through college without debt, provide them with vehicles and weddings without debt.

ReplyDeleteOur gift to them.

I don't quite know how to act without all the college expenses, but the retirement fund is building. My husband can do anything and I like learning new skills too.

Our one downside is that our town does not have good medical care. Shortage of drs. So we plan to eventually move to a larger city near one of our children to ease the burden on them and us.

But we are enjoying the good life.

Connie

I really enjoyed this post. We have achieved a lot of the same goals as Rhonda- acreage ,animals, mortgage free. We have also been blessed with small grandchildren who live ( with their parents) close to us.

ReplyDeleteI am in the process of watching a big change in my husband- a workaholic for most of our 36 years together- he is easing off so much

The cause of this miracle is the 3 little grandchildren. He has a medium sized company and to tell the truth I thought he would go from work in to the grave. But no , he now pops over to our daughter's place for morning tea and will baby sit happily so we can have a girl's morning out.

This was one area of our life that has always concerned me- but now I see that we can and do change as we get older. Hubbie has instigated planning our next holiday - wait a minute that's my job!

Great post, I am not in my 40's quite yet but am grateful for this perspective and hopeful for the future. My wife and I have made efforts and set goals to live life now simply so we are able to transition later in life without major changes.

ReplyDeleteThanks for this great post Rhonda... good food for thought.

ReplyDeleteI am in my late 40's and it's amazing how our thoughts change as we age. We realize now that we have to go like mad to pay our mortgage off so we can then concentrate on our retirement.

Wishing you and Hanno all the best,

Tania

Thanks for the feedback re the chickens Rhonda.

ReplyDeleteI'm still mulling it over...

Frogdancer, please come over to the DTE forums and ask questions of the chook owners. We would love the chance to indoctrinate you!

ReplyDelete