Both images are by the wonderful Swedish artist Carl Larsson from here.

We are very used to earning good money and are now confronted with dropping to only my husband's very good wage of around $100,000 p.a. So I've spent this evening working on our budget ... We anticipate that the mortgage repayments will drop somewhat as we renegotiate our loans in November I believe.

As it is, I felt we were doing well to only have one old reliable car with Jack riding to work each day... and not spend a lot on clothing or cosmetics... but on doing our budget tonight I'm realising that we've been living over my husband's wage for several years at least. We haven't really tracked what we spend, other than putting a cap on our individual 'sanity allowances'. I know I have spent a lot on organic food and alternative health. We waste food and hope to do more home cooking - I have been eating more intentionally while pregnant.

(They have a good emergency fund but the sanity allowance (pocket money) Jill writes is $200 a week.)

Generally, we aspire to tithe 10% (which we've done consistently) and invest 10% (we haven't done this in the past several years).

I like the idea of not being forced back to work by money but rather by interest or previous employers 'needing a hand'. We plan to have two kids which I guess might mean that I'll be at home for 5 years. I now have an ABN and can consult from home but don't know if this will pan out or if I'll want to distract myself from the kid(s).

Family have a lot of second hand gear for us and we'll get significant presents from older family eg. prams etc.

Key questions:

- How much should it cost us to live well? Particularly the food budget!

- How much do kids cost? In the first year of life and later?

- Should I be planning to go back to work, or can we easily live within Jack's salary still tithing and saving for our future?

Jill's email was much more comprehensive than the summary given above but it was much too long to include all of it. I don't want to give any advice on the cost of setting up for a baby other than to encourage Jill to accept all the secondhand and pre-loved clothes and equipment that she's offered.

I do want to address the change of mindset though, Jill. It's a change that will take you from being a young couple who have worked hard and had the good fortune to buy a home and many of the other things you want, to being parents with the responsibility of raising a family. When you think about it, up until now, you two have been the children, buying what you want, going out and enjoying life - as you should. Your baby will change that. Not only in monetary terms but also in the amount of spare time you'll have. There are many parents earning a lot less than you who have children, so it certainly can be done. I think it's best to consider the kind of parents you wish to be then work out from there. Work out what kind of life you want for your family - money is just the means to get the lifestyle you want. One thing I do know with certainty is that there will be change and sacrifices coming and there is no way around that. Some of them you'll love, some you won't love but they'll just be some of the changes that a baby will bring.

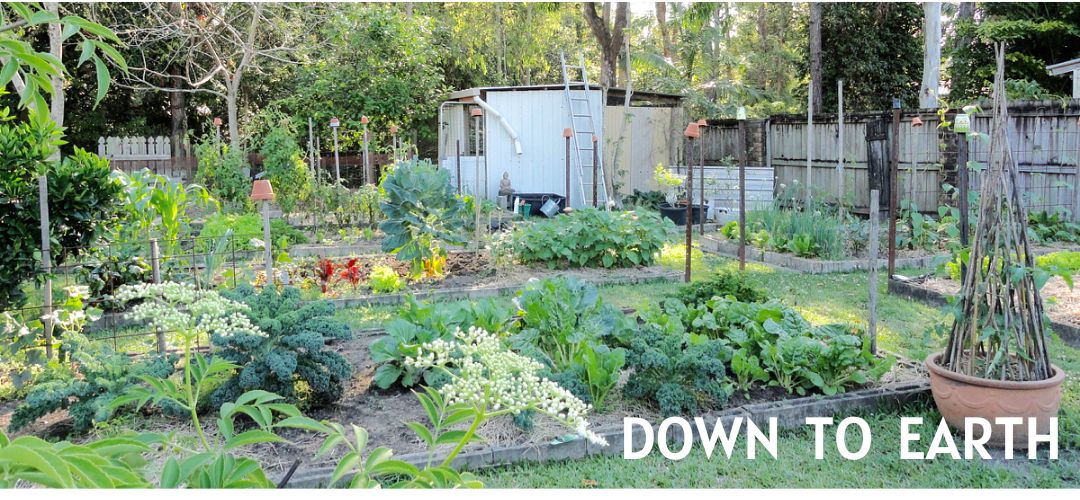

I hope you can address the matter of food wastage. You can do that by sticking to your budget and with menu planning and stockpiling. I believe fresh food is better for you than organic food that has travelled a long distance. Try to find a butcher and fruit and vegetable market and develop a relationship with the owners. There are a lot of growers who aren't certified organic and yet they grow their produce with no insecticides and herbicides, and if they're local, they'll be fresh. You need your food to be full of nutrients and fresh food is more likely to have them. There is a section in your budget for gardening, maybe you could enlarge on that, put in a vegetable garden and grow organically.

It would be great if you did track your money from now on, maybe for a month or two to see what you're both spending. I bet you'll be surprised. You have a lot of guessed items in your budget and you need to know the reality of it. For instance, you're spending $2000 a year on dental on top of your health insurance, and $15,600 a year on food for just the two of you. One of the sacrifices you both make may be that you halve your sanity allowance to $100 a week and put the other $100 towards your mortgage.

And now it's over to our dear readers. If you have any useful information for Jill and Jack, please take the time to comment. I am sure they're not the only parents to be or new parents reading here and there are many experienced parents here with a lot of knowledge. Good luck!

I hope you can address the matter of food wastage. You can do that by sticking to your budget and with menu planning and stockpiling. I believe fresh food is better for you than organic food that has travelled a long distance. Try to find a butcher and fruit and vegetable market and develop a relationship with the owners. There are a lot of growers who aren't certified organic and yet they grow their produce with no insecticides and herbicides, and if they're local, they'll be fresh. You need your food to be full of nutrients and fresh food is more likely to have them. There is a section in your budget for gardening, maybe you could enlarge on that, put in a vegetable garden and grow organically.

It would be great if you did track your money from now on, maybe for a month or two to see what you're both spending. I bet you'll be surprised. You have a lot of guessed items in your budget and you need to know the reality of it. For instance, you're spending $2000 a year on dental on top of your health insurance, and $15,600 a year on food for just the two of you. One of the sacrifices you both make may be that you halve your sanity allowance to $100 a week and put the other $100 towards your mortgage.

And now it's over to our dear readers. If you have any useful information for Jill and Jack, please take the time to comment. I am sure they're not the only parents to be or new parents reading here and there are many experienced parents here with a lot of knowledge. Good luck!

I would tell Jill to approach budgeting from the bottom up...as in what it takes to live and then add on to that. Rather than deciding what to eliminate. Of course, breast feeding would save tons of money as would gardening and cooking from scratch. But the most important thing I would tell Jill would be to cut herself some slack. A new baby is life-changing. Her day will soon be determined by the little one and that's how it should be. So I hope she doesn't feel guilty about having a newborn and also needing to get into the garden to hoe or even put a meal together for a while. For me, I wasn't back on track for quite a few months!! Congrats on the baby, Jill!

ReplyDeleteKris

Just a quick response as off to work. For myself and two children I spend up to $10000 a year on food, and it's almost 100% organic. That includes food for 2 dogs and 2 cats too.My kids are 10 and almost 13 so they eat a LOT.

ReplyDeleteEverything is cooked from scratch. I can spend less than this by spending more time in the veggie garden - even just some pots of lettuce and herbs could save you $10 a week - that's $520 a year!

Good luck,it really can be done!

Madeleine.

I remember a blog that you may even have featured a while back where a mom shared how she spent very little when having her first baby but I cannot find it! This blog however seems to have a great balance sharing the wisdom and folly of their choices which is good to know because we are not perfect and we make mistakes and buy t hangs on impulse. do however want to say that 18 years ago I left a lucrative career to come home at 8 months pregnant and we are so glad we did what we did and cut costs so that I could be at home with our now 4 children... One must do what needs to be done. Sometimes things work themselves out as you go as LNG as you stay aware and vigilant about your choices. All th best Jill!

ReplyDeletehttp://thatwifeblog.com/2011/07/19/cost-of-having-a-baby/ sorry but my iPad wouldn't allow me to post the blog link in my previous comment (and for the terrible spelling!)

ReplyDeleteHi Rhonda

ReplyDeleteSome great advice. I would say, after 2 babies, you don't need half the stuff you think you will. I saw an ad for a gadget that warms the baby wipes the other day - Lordy! Anyway, here is a link to the Minimalist Mom's book on Baby's FIrst Year and how to avoid the mad spending that seems to come with a baby. She has some really sensible advice and I wish I'd read this book when I was pregnant (and I am not affiliated with minimalist mom, I just love her philosophy!)

http://www.theminimalistmom.com/book/

Best regards, Anne

I also love the minimalist mom blog ... so practical. Another book I just read was 'simplicity parenting' by Kim John Payne which gives great info on how kids thrive with fewer material possessions.

DeleteMy other tips are don't try to buy everything you think you need straight away, you often realise its not essential or you may find something that works better. newborns especially don't need much. The best kids toys are often things you use around the house ... kitchen pots, bowls, spoons, tongs, cardboard boxes, vacuum cleaner pipes etc. good luck and enjoy the ride :)

Yay! Congratulations Jill and Jack on your Baby to come. My tid bit is breast feeding , cloth diapering and homemade wipes. Breast is best for your little one and saves so much money. Cloth diapers are so much more healthier for your baby, there are a lot of chemicals in disposable diapers. Wipes are pretty pricey and full as chemicals as well. If you don't have to buy those 3 things you will save a great amount. Best of luck and Congratulations again!

ReplyDeleteMy daughter has just had her first baby and realises now how little she really needs. I think cloth nappies are an important investment if you can manage. They save a lot of money over the years, within a few months actually. And learning how to LOVE a life of less. I have never been as content as I am now living with less but eating Inseason organic food. Just doing this will save you heaps. The extra cost of organic food is really eating out of season and buying organic processed food. As Rhonda says, fresh is best and cheapest.

ReplyDeleteCongratulations on the new little one on the way, Jill!

ReplyDeleteI think a lot of your cost of living questions you can answer yourself if you put together a budget and track your spending. It really does take about 3 months to get a good workable budget in place, so keep at it :)

To save money with our first one, these are a few of the things we did:

Cloth diapers (hung on the line to dry)

Breastfeeding

Purchased things that we had to buy ourselves in great used condition. Babies outgrow items so quickly they don't have time to get worn out. This really helps for the second child. You won't have nearly as many things to buy.

Made our own baby food from our meals that I was already cooking. I made teething biscuits as well.

We are in the U.S. and eat about 70% organic. Our monthly food budget is usually $350-600, depending on the season, for a family of four. We are in a rental at the moment, so not producing any of our own food.

In the U.S., chlorine-free disposable diapers cost about 35-40 cents each. A newborn will go thru about 10-12 diapers per day, and less as they get older.

Formula is also quite expensive. I have friends that were spending $120 per month on formula for their baby. This was for non-organic formula.

Now that my kids are past the baby stage (ages 2 and 4), I budget $40-50 per month for kid-specific expenses. This amount does not include college savings, it's just our everyday expenses. We don't use paid babysitters or daycare, or I'm sure this amount would be much higher.

I hope some of this helps. Best wishes for a happy, healthy baby!

HI Rhonda

ReplyDeleteI would stress to Jill the significant savings that breastfeeding provides. Of course we all know the health benefits for mom and baby, but here in the US a years worth of formula costs nearly $2000. Investing in the help of a professional lactation consultant, if needed, will pay her back financially (and every other way... never met a mom yet who was sorry she nursed!!) I always joke that I'd like to write a parenting book called "Everything you DON'T need when you have a baby". In my case, with twin girls and many relatives, I received two of everything I didnt need! I was able to return many many swings, bouncers, cradles, wipe warmers, toys, newborn clothing etc for gift cards and used those to buy diapers and other necessities for an entire year. I definitely believe that cloth diapering saves a major amount of money, especially since she plans to have another baby in the future. (I didn't have the support and wasn't ready to tackle it alone while learning to bf twins, but in hindsight I wish I had invested in that expense up front.) While some baby items can be a life saver they are also used for such a short time that its crazy not to borrow or buy used (I'm thinking swings and the like which get used for a few minutes during dinner for a few weeks and then are done!) What you REALLY need for a baby is a sling that you love and plenty of burp clothes! They certainly need very little clothing in the first year and grow out of it so quickly that again its crazy not to take hand me downs. I know I fell for the marketing that comes along with baby showers and your own excitement about your precious baby on the way but after having been through it and seeing all the wasted things we didn't use or only used once I felt terrible about the waste. Unfortunately everyone else is in the same boat and we found it difficult to unload, even through donating, many of our "like new" used baby items. My advice is to return practically everything you receive as gifts and save the money for when baby comes and you find what you really DO need! Also ask people to get you things for down the road... forks, spoons, cups, potty, toddler car seat. People WANT to give you things but we all fall for the newborn stuff that passes so quickly! Resist all the adorableness... your baby will be cute enough without any extras!!

I agree! We were fortunate enough to borrow things like swings and play-mats from friends whose children had outgrown them, and low and behold, our daughter loved then fiercly for a time, and then outgrew them. So glad we didn't register for them ourselves and instead our friends and family focused on needs - diapers and other supplies, books, neutral simple onesies and jammies. I"ve since shopped Goodwill and a second-hand sale to replace the things she's outgrown, but have only spent maybe $100 US on baby, other than diapers - they're our biggest expense. We opted to go with chlorine-free disposables as I'm the breadwinner and my husband is the stay-at-home dad - he didn't feel he could manage cloth so we picked our battle. Really, everyone has been more generous than I imagined. I was able to return a lot of things that didn't fit with our philosophy - silly toys and DVDs being the most common - and then use the gift cards on other things.

DeleteWow congratulations Jill and Jack on your upcoming birth of the greatest thing that will ever happen to you and change your life forever.

ReplyDeleteI have not raised any children for many many years now and as of yet have no Grandchildren so I have no idea how much or what you need. I do know that a baby does not need everything you think he or she may need there is a lot of things they do not need. They need food and shelter and loving parents not all that fancy stuff. You will be just fine. My girls turned out to be responsible, happy adults we did not have much but they had lots of love and that is most important. Do not stress too much it will all work out. B

Well Jack & Jill the first couple of months you wont be needing to spend any money on entertainment- you'll just sit and watch your baby in awe! They're great time wasters! :)

ReplyDeleteAs others have mentioned- breastfeeding, cloth nappies, hand me downs, cooking from scratch etc are all great money savers. We really don't spend that much on our baby, she eats whatever solids we're eating, I buy a lot of her clothes at Vinnies and sew others. Having a baby is something you can't be 100% prepared for as you just don't know who this little person is going to be and what their specific needs will be. My only suggestion would be to live just on your husband's wage now, put all your earnings into savings, and work out the kinks in your budget while you can afford to make mistakes. Good luck!

Congrats to them !

ReplyDeleteBabies really don't 'need' that much, and luckily, because they grow so fast you can get most things secondhand. Just don't compromise safety, in my opinion, especially with a carseat, sturdy and safe cot/mattress - they'll spend a lot of time sleeping (hopefully!). Other items can be picked up very easily - hand-me-downs, op -shops, even look up local 'kids clothes swaps'. I went to my first one the other day, there was so much baby (size 1 and under) piles and piles of clothing.... if you didn't donate/contribute it was $1 a piece/bundle. crazy! most things just need a wash and an airing and they are good. Look for good quality stuff as it lasts longer and washes better. Theres always gumtree, local facebook pages are great for buying and selling kids stuff. Talk to people about what they like/didn't like, why, see if you can borrow things like slings or prams for a little bit to see how it works for you before committing. Ask lots of questions, of anyone, about anything !!

And just as others have said, cloth nappies, and wipes, breastfeeding, make your own steamed vegies, puree, jar and go! (check gumtree - some people give away baby food jars - perfect size, reusable, and glass - so no plastics). Rhonda has so many wonderful ideas on this blog !!

Best of Luck!

Lauren

:)

It's many years since I had our babies. Grandma now. I agree with downtowndownshift, live off one wage now in preparation. Breast feed, & be glad of hand-me-downs. I wondered how we would manage when our first came along. We had only recently moved into our home, paying a mortgage. My wage was needed, but because I didn't go back to work, we got by on less.

ReplyDeleteHope all goes well when the time comes. I expect you will tell Rhonda all about it, who in turn will tell us!

Angela south (England) UK

We have been in this exact same situation as we came from being professionals working in remote mining locations to being on one wage with two little children and a mortgage in a capital city.

ReplyDeleteRegarding baby things: buy good quality second hand things, accept handmedown clothing and try op shopping.

Changing spending habits - here are my tips

1) track your spending.... Every last cent. We started doing this years ago and it helped us make some more strategic decisions regarding our spending (ie ... Did we really want to spend that much on alcohol! Eeek!). You can quickly see where big changes can be made eg shopping around for insurance.

2) Sanity money: get it out in cash each week and anything you don't spend goes into a jar ... Saving for a big purchase. We started out with $100 each per week and then reduced it to $50, this quickly sorts out your priorities!!! I stopped going out to cafes and buying books (I'm a big library user now) because I prefer to spend my precious cash on craft supplies hehe.

3) food: menu planning, cook from scratch, shop for specials, garden (growing your own herbs will save you heaps just as a start!), eat food that is in season. We used to cook pretty elaborate meals with lots of ingredients required - living in remote locations cured us of this and now we tend to eat very simply, which is also easier to handle with little children. Our slow cooker was a great help to me when I started to take over more of the cooking load.

Congratulations on the impending arrival of your little one. If you keep, in the forefront of your mind, that the two things your little one will need the most are your love and your time , then you will be able to resist some of the tempting "wants" (many toys, many clothes etc.) that new parents are often encouraged to buy. Few, good quality and beautiful toys and second-hand, pre-loved clothes (your baby grows out of them so quickly) will be just fine. Letting your family and close friends know what 'special items' you want is also a good idea and gives you the choice to select things that you can re-use for your second child.

ReplyDeleteOur family chooses organic food whenever possible and it's a significant part of our budget but then we have a very old tv, go out into nature for our entertainment and don't have a closet full of clothes or shoes that we don't wear. We still have special treats occasionally and that's why they are treats.

OUr child is happy, healthy and much loved ... your child will be too!

Congratulations! My son is a year old, and when he was born I had collected a lot of unnessesary stuff, just because I thought I must need it. Everyone else had mountains of contraptions, so I thought we did to. There is such a huge marketing campaign aimed at mums, who don't want their kids to miss out or develop 'wrong', and who will buy much stuff out of this fear. What I have learned is that all my baby needed was a blanket on the floor with simple, open ended toys mainly found in the kitchen for play time, and while friends propped their bubs up in swings and bumbos in front of tv, or took to strolling around shopping centres all day, we have taken a much simpler, more pleasurable path that I attribute to finding blogs such as down to earth, and Janet lansbury's 'elevating childcare'. I think when I had Eli I really wanted to find a new way of living and thinking, and I am still far from baking my own bread but small changes one at a time! I reccomend Janet's blog in regards to caring for small children as the philosophy of 'do less, observe more, enjoy most' really resonate with me and against the past paced, consume consume message you will hear every where else. Also cloth nappies are great! I have a few different types but find baby beehinds really durable and less leaky :-) good luck and have fun!!

ReplyDeleteWe do not yet have children but hope to in the future so I am enjoying all of the great advice. The first thing I would look at is your sanity allowance. If it were me I would cut it back to $50 a week and enjoy the sanity that comes from being an extra $300 a week ahead on my mortgage. If your baby is due in March that could be nearly another $5000 on your mortgage. Also if you have a baby shower you could ask everyone to get you gift cards that way you are in control of what it gets spent on and will not have to worry about duplicates, trying to exchange things or ending up with things you will not use.

ReplyDeleteLots of things are marketed as essential to baby, but quite frankly, you do not need half of it. Even the diaper pail we had ended up being sort of silly because it smelled and there was no hassle to just bring the diaper to the garbage outside. Our cloth diaper bag never smelled like the diaper pail so go figure. You also do not need special baby laundry detergent. Big rip off. Find a fragrance free brand or use Rhonda's recipe and you should be just fine. We use Ecos Free and Clear.

ReplyDeleteBuy a new carseat unless you know someone who has one a year old. Here in the states there are limitations to how old car seats can be. We were fortunate and got a hand me down from friends when their little one turned one.

Hand me downs are the best gifts Be it books, clothes or shoes. Then you can pass them onto the next person who can really use them. The old school saying someone told me when I was pregnant last year was "A baby brings his own" and it is true. People love to buy things like clothes. I highly recommend you ask for sizes 9mos and older as well because everyone buys the adorable itty bitty sizes, but it is the bigger sizes you will end upneeding more of!

I did breastfeed but due to issues had to go to formula. I would like to say that store brands like Target/Wegmans, etc are on par with Similac and other name brands because they have to be. They are also half the price. Same goes for store brand diapers if you choose disposables. We did cloth and disposable. For cloth we used gDiapers.

Food is organic. Avocados are a fantastic brain food and easy to mash up and freeze for future use as well.

As for play time you are the most exciting and interesting "play thing" for your baby. Reading a book aloud that you are reading will make the baby happy because it is your voice. Sing nursery rhymes, just talk to your little one that is all they require.

Enjoy this time because it does go fast! :) Congratulations and Best of Luck to your family!!!!

Find your local toy libray. I have four children ranging from 2-7 years old and I wish I'd found it sooner - I can have the items (which are in near new condition) for 1-2 weeks for the bargain price of my membership of $28 for the year !! some are more expensive the most I've heard is $100 for the year but imagine the savings & the kids never get bored with them because they are discovering something new every 1-2 weeks and there is no waste, nothing just sitting there not being played with.. The items range from baby to around the 7-8 year old mark...Most neighbourhood centres run them or your local council may be able to assist.

ReplyDeleteCongrats on the new addition. Im a mum of 4 ranging from 11 to 19. Alot of comments I would have made have already been addressed, such as breastfeeding.(Which I almost gave up one after struggling for 2weeks with number 1 but it got better by 3 weeks and I wondered what I had been worried about and the other 3 babies took straight to it). I wanted to use lux flakes to wash the babies clothes in with their sensitive skin but they were very expensive so we bought a bar of pure soap and a $2 metal grater and grated our own for about a tenth of the cost of the lux brand flakes. One thing Id like to mention is that I wouldnt have been able to keep up with a new vegie garden and a newborn as I wasnt in the habit. I know so many do but if you use alot of this or that you could have a pot of tomatoes or lettuce in easy reach of your back door or a small herb bed. It just may be a hard thing to start up at that time unless its already established and already part of your routine. If you do like to buy organic, it may be worth yours and your husbands time to try and add this step into your routines now. I made my own wipes when it wasnt the trend to do so from my second child. That is quick and easy and wont take up much time. I stock piled some disposables with my first while I was pregnant for use when I first got home and then to use when we were out and found that when I put my son into the cloth nappies he got a bad rash. I know the modern cloth nappies have come a long way since then. I lived in tas and had winter babies so you do need to take into account the ability to be easily able to dry the nappies. Forward plan some purchases if you intend on having two close together, think about the pram that will enable you to add to it to transport a toddler too. My sister just had a baby after a very long gap away from it from her older family and she uses alot of facebook buy and sell to buy second hand big ticket items. She was given a baby swing but didnt use it much. Ive also noticed that you can buy portacots for around 150 that include a bassinet a change table and then as the baby is older the base drops down to the bottom to be used as a regular cot. The main things I used daily for mine bassinet, then cot, a pram, carseat a foldaway change table and a rocker/bouncer seat and a high chair later on, I didnt use a walker. I had a reflux baby and found the jolly jumper very good for keeping them upright. I borrowed one for my 1st and bought one for my second and sold it for a good price. I bought the 0-4 car seats so I didnt need to replace them as they moved through the stages. Try to get things like white singlets so you can use them on either gender. My next door neighbour thought I was odd as I had a whizzbang nappy bag with all the segments etc. She just grabbed a plastic bag as she was leaving and put in what she needed. It worked just as well. Of course you dont need it to be plastic any bag you already have is useful. I think a backpack would be good as a hands free option too, if you had one about. I also bought very little baby food as when my kids were little there were alot of scares about people contaminating it. I just mashed up the vegies we were eating finer and stewed an apple or a pear or mashed a banana. We are only on my husbands wage of around the same as your husbands and now find it very difficult as our kids are older. I am going to have to go back to work. The main thing is to be organised with electricity bills etc, so do your research now as to what you spend and start to be in the habit of putting away for the big bills as they come. Another blog I regularly follow that may be of interest to you is an Australian one called frugal and thriving. She is a stay at home mum with a toddler and a baby and has alot of bugeting tips and mortgage tips and may be more in your demographic.

ReplyDeleteCongratulations on your first baby....it is such an exciting time that's for sure. I would track every cent spent in a little notebook and I would also use CASH........ somehow getting a $20 out of your wallet and handing it over is more meaningful and visual than handing over an eftpos card where you don't actual handle "money" and "money" is exactly what you are spending.

ReplyDeleteI would also live off one way immediately and with the other put it into your mortgage or 50% into the mortgage and 50% into a high interest account to cover your next year's bills. While you have the 2nd income you can tweak things if some weeks you run out but once there is no second income it's harder to get used to it so from next pay live off one and make use of the other. Budget, meal plan, shop once a week (always saves heaps of money). With a new baby coming you will not have a lot of time on your hands so get used to using your slow cooker and cook double...eat one and freeze the other. Library for magazines and books - mags are $7-$10 and then you throw them out.....if you aren't doing cloth nappies and buy disposable nappies buy in bulk as it is the only way. In Australia Aldi nappies are half the cost of other brands and are very good even though my two (now 8 and 6) are well and truly out of nappies. All the best....one last thing if your mortgage is large and you can't make ends meet on the $100,000 then maybe downsize just a little to reduce the pressure of the mortgage. Kids need mums and dad's around, love and a roof over their head...whether they live in a 3 bedroom house or 5 bedroom house what kids notice is mum and dad being available and around...so this might be something to consider as well before the baby arrives and get settled into a new place. Or just a couple of suburbs over that is slightly cheaper maybe. It is worth it to have your family's lifestyle and be there for your kids....it's just a thought

My first baby is due in February and I have really enjoyed reading everyone's comments and will take them on board too!

ReplyDeleteI'm lucky enough to be able to access paid parental leave in one form or another for 10 of my 12 months off work (I'll have to go back to work after that) and my husband and I earn less than Jack and Jill but we have been showered with hand-me-down baby clothes and a cot and i'm sure we'll get more things as we get closer to welcoming our little girl to the world.

We'll be using cloth nappies - I have already invested in a few good quality ones but my biggest issue at present is fatigue. I used to bake our bread and make our cleaning products but I simply don't have the energy at the moment. Luckily I made a huge stash of washing powder one day when I was feeling energetic but the rest has fallen off. I'm thinking now of buying a bread maker to make life easier.

Does anyone have any tips on ways to make life easier for a very fatigued pregnant woman who also works full time???

My advice: be kind to yourself. I beat myself up with guilt with my second pregnancy when I had to use disposable nappies with my eldest. I could barely walk by 20 weeks, thanks to a dodgy pelvis, let alone carry a nappy bucket. My Mum had to do our clothes washing and I felt it was unfair to her to add dirty nappies to her list. I also had to stop making my own products and just use the bare essentials. My youngest is now 15 months, my pelvis and fatigue are improving. She's well and truly in cloth nappies now (my eldest now toilet trained) and I'm back to my making my own cleaning and body products. As frustrating as that time was, it didn't last forever and I wish I had just rested and enjoyed the pregnancy and then my little newborn instead of worrying so much. Good luck!

DeleteSara

My advice is to prioritise sleep like you never have before :o) Go to bed earlier and try and nap on the weekends. This advice also stands for after the baby is born too.

DeleteWhen my second child was a newborn, some nights I would go to bed at 8:30. I also expressed milk so my partner could do the 10o'clockish feed. This meant that I was getting a good amount of sleep in before the 1o'clockish feed and whatever happened thru the night after that.

All great advice here. I would like to comment on the food wastage issue. We used to waste an obscene amount of food and it wasn't until I started to look at ways of cutting costs that I actually faced up to the wastage, which I might add, was a shameful amount. For every 10 bags or so of groceries I brought into the house, I am very embarrassed to say that I would throw out at least 2 full bags, mainly dead fruit and veggies, but also often thawed meat that didn't get used. I cringe now when I remember those times (not so long ago!).

ReplyDeleteSo, here's how I addressed it. Firstly, I used everything, and I mean everything. Save the chicken bones in the freezer and when you have enough, slow cook them for stock. Keep a covered container on your food prep bench and put all your peelings in there for the compost. Any wilting veggies are used to make soups and stews or just added to whatever I was making at the time eg chopped celery, carrots into spag bol. Revive lettuce and celery in vases of water.

Fruit that started to look dodgy is chopped up for fruit salad. Drain any canned fruit and freeze the juice for iceblocks.

Use those green veggie keeper bags in your crisper. Only buy what you really will use in the week. If you thaw out meat for tonight and don't use it, cook it in the morning regardless. It can be sliced or minced for sandwiches, curried, whatever.

Use a menu plan and be realistic. It is unlikely that Jill will have the time or the inclination to spend hours on gourmet meals so keep the plan simple and have some emergency meals like spaghetti, tinned salmon, tinned tomatoes that can be put together quickly. If your recipe says it serves 4 - 6, put the extra servings aside to be frozen first, then serve up the rest between you.

Good luck with everything!

I have been a stay at home mum for almost 18 years, we have lived on one income and had 6 kids in that time and my husband does not earn any where near 100K p/a and we have managed including a beach holiday every year and activities for our kids etc. It an be done just be wise with your money and where you choose to spend it!

ReplyDeleteKmart/Target clothes and things may have to replace more expensive brands, op shops or hand me downs are your best friends. Choose cloth nappies for the environment, but the cost of disposables is blown out of all proportion when reported on pro cloth nappy websites. There were times in my younger chn lives when I had to use disposables and they cost me around $40 a month to buy a box of Huggies (as long as you don't change the nappy every wee and baby doesn't poo every feed) which works out at around $500 a year and no where near the 1000's of dollars reported on the Modern Cloth Nappy websites, particularly if you spend that amount to set up a MCN system, buy 2nd hand ones if you can or use old fashion folding ones.

Don't buy a baby bath, bath baby in the laundry sink or shower with baby- they love it! they grow out of the baths and move into a proper bath so quickly they are not worth it.

I know it has been mentioned before but breastfeeding is a wonderful experience and while it saves money it has so many other benefits for you and baby that it is well worth working through any early problems!

I agree about the cost of disposables v's cost of cloth can be way over inflated. I calculated that I would save less than $500/year by going with cloth - and I'm talking terry flats and pilchers, not the $40/MCNs that are popular. $500 is a significant amount BUT not the $1000's that are often quoted.

DeleteI also agree with the baby bath thing, our second baby was never bathed in the baby bath; my partner would get into the bath with the baby and the toddler which was a lot of fun (apart from the poo in the bath incident). Once she was sitting up we started supervising from the side, she tips over every now and then but we are right there at all times to fish her out.

We had a much lower income than Jack and Jill and still a decent mortgage payment every month and so it is definitely doable. A lot is mentioned above (don't buy baby food - just whatever you are eating with some exceptions of course; breastfeed; etc). One question you had which isn't much addressed is the "should I go back to work". I went back for only 2 days a week but shortly thereafter my husband was off work and so I worked 4 days a week. We found that when one of us was home, our expenses were always lower - you can make dinner in advance and no last minute rush to get something unplanned. You can pop into the different stores to get specific bargains, instead of just buying whatever, whenever. You have time to go the farmers market (we would also buy trays of things in not best condition - you can do so much with food that isn't 100%).

ReplyDeleteYou don't need new clothes while staying at home, you don't need someone to clean your house, you don't feel stressed, etc. Oh and yes, definitely make meals in advance and freeze half. Those came in SO handy in the first few weeks for us.

Fantastic news so happy for you my best thing I can tell you is cloth nappies are great and if you can budget it there is a service for it you just pop them in a bucket and they pick them up and bring new ones

ReplyDeleteLinda

I just thought of something else: start thinking about if you will want or need to return to work after baby - even if it may be 2 years away and who will look after your child. Don't wait and assume it'll fall into place because daycare waitlists are very long and demand is more than supply, so you'll need to consider looking into that. Get onto waitlists as soon as possible if that is the case (if they allow for "baby xxx, due xxx" or start chatting to them and get forms organised for once bub is born and you have details. Also, Aldi disposable nappies are just as good (I find better!) than Huggies, and are lots cheaper :)

ReplyDeleteCheap and Easy meals will become your best friend - toast, fruit, left overs, anything you can eat with 1 hand :)

Lauren

These are great discussions....always appreciate to read about how others cut costs. One big thing I'm noticing is how much people feel they have to budget for the baby and baby things. From my experiences I would suggest that it's not really getting set up for baby that is going to do a person in but more the regular budget weekly/monthly. For baby I found government baby bonus and family allowance to be more than enough. Our kids are 6 and 12 and I am a stay at home mum and really benefit from the govt payments. I realise this is different for everyone but hopefully you too will feel this helpful.

ReplyDeleteWe were married 5 years before we had children and really had to assess our current spending habits. Eating out, expensive meats and snacks, using credit cards! to name a few. A last minute decision while in town to go out for lunch or grab a bite to eat can mean $50 or more. On one income $50 becomes so much more precious. I am a big fan of my slowcooker/pressure cooker. This way we can still eat meat which we all love. Plus the bonus of the slow cooker is that I am organised and the food cooks itself. For our family of four (in West Austr)we spend around $1000 monthly on groceries which I would LOVE to cut back on but haven't succeeded yet.

And like someone else mentioned....look for free things! The library is great not only for an outing but also to get free books to read :) and I get out so many magazines which I then don't have to buy, cooking/recipe books, they have many books on how to leave simple....everything is there and it's all free! i get abit carried away with that....I love the library :) Depending where you live there could be nice bike/walk paths, parks - kids never have enough of that. And an outing to the second hand store is a blast and doesn't cost much. Invite friends over for a coffee instead of going out. Rather than a burden it can become a fun challenge to discover your town/city and find simple, cheap or free things and ways to shop and live cheaper. For myself I love that I can stay home and have the time for this challenge and wouldn't have it any other way.

Enjoy preparing for your little blessing!

I stay home with my daughter and my husband earns about the same as yours does so I guess that what I'm trying to say is that it is quite possible but it does take a bit of getting used to changing your mindset about money when you have not had to do this before. $100,000 seems an enormous amount, but as I'm sure you know, it is taxed very heavily and the take-home wage is considerably less.

ReplyDeleteAs others have said babies don't cost as much as you would think - 90% of everything the stores try to convince you are "must haves" are really completely unnecessary. You will need to buy a car seat, but a good pram, cot and changetable will be cheap to purchase second hand. Using cloth nappies, breastfeeding and later making your own baby food will cut down expenses enormously. Using cloth does not need to cost thousands of dollars at all. It's a good idea to ask relatives to give you basic clothes in slightly larger sizes as a lot of the lovely things that you receive as gifts may never even be worn if they are 0000.

The thing that ultimately decides if you can exist on a single wage is not so much the baby expenses, it's the general cost of living. I agree with the comment above who suggested figuring out all of the essential expenses first like mortgage, car repayments, rates, power, insurances, phone, registration, fuel etc and then figuring out how much you have to play with after that. I remember being really shocked when I did this at just how little was left. You have to be willing to compromise on certain things or you just won't be able to make the money stretch to cover all your costs, have a little over to spend and put some aside for a rainy day.

This may not be what you want to hear, but In all honesty, I don't know how you will be able to both save 10% of your income and tithe that amount also while paying off a mortgage all on a single income. We do not tithe and still have had to cut out most little luxuries just to be able to stay afloat, pay our comparatively small mortgage and be able to put a small amount each month into our emergency fund (I only wish that it was 10% of our income!) and we certainly can't afford to eat organic or have $200 a week pocketmoney. I know it is a contentious issue, but you really need to think hard about if you can afford to tithe at this time. I can't stress enough how important it is to have money set aside for "just in case".

If they tithe 10% of Jack's gross income the figure is less than $200 per week. If that is what their consciences dictate, they should do that. I'd suggest that come out of the "sanity fund." Of course, their conviction might be to tithe the after-tax income, which of course would be much lower.

DeleteIf they can afford it, then certainly it's fine to do that...but I think that in order to do so they will be struggling that much harder. What people fail to realise is that on that kind of income you are in the highest tax bracket - Jack's will pay at least $25,000 in tax and they will not be entitled to many, if any of the allowances, rebates, healthcard benefits etc that other single income families use to make things a little easier. It doesn't sound like much, but it all adds up.

Delete10% of a tight household budget is a lot of money no matter how much the gross income is. $400 a month can mean the difference between it being financially viable to have a parent at home, or being forced to return to work just to make ends meet. I personally think that the church should consider reducing the 10% that they currently ask for in light of the fact that housing/living expenses are now so much more than they used to be. Not many families can afford to save 10% (or any) of their income, much less give it away.

We live on a wage of around $50k. It's a pinch if unforseens happen like a sudden job loss or an essential part of the house/car needs repair. But we manage.

ReplyDeleteAround $8,000 is spent on food (some organic, some conventional). We include things like toilet paper and other non-edibles, in that budget too. We've managed this by not buying convenience foods and simplifying our diets. Instead of having everything we could possibly want - we eat those things we really love, so there is no waste. Staying at home means I can cook what we like.

We've had one baby (now nine) and I recently discovered I'm pregnant with #2. We had a couple of unforseens, so our budget is tight. We don't really need a high chair, as I can feed them on my lap, wearing a full bib apron. I don't really need a change table either, as many past generations have used the floor and bed successfully. Just need a change mat.

I would recommend breastfeeding if you can do it. I wasn't successful my first time, so formula was it. Aim for best, compromise if you need to. I would also recommend cloth nappies, although I used disposables last time. I will attempt cloth. If it turns out baby develops 24 hour reflux or sleep difficulties, I will switch to disposables for that period. I'm all for doing the right things to save money and is best for baby - but compromise isn't wrong when needed.

We plan to keep our newborn in our room for the first few months, in a small cot. They are due around winter time, so we won't have to run another heater in another room just for baby. When they get old enough for their own room, we'll get a bigger cot and put it in my sewing room. They only really need the space to sleep in and store clothes, otherwise they will be in the house with everyone else during the day.

Whatever you choose to take away from today, you're going to have to tailor it to your situation. You'll hear how people save money by "x" or "y", but some costs might be unavoidable depending where you live, and the babies health (therefore yours).

Whenever I used to do budgets in the past (I'm not completely disciplined yet) I would aim for best case scenarios. It's the model banks use to determine how much you can borrow, it's what all the insurance companies use to determine how much cover you need, and it's how governments make their budget forecasts for the nation. Life rarely works to best case scenarios however.

I've since learned to plan for worst case scenarios so you're not left hanging when the bank won't negotiate new payments, insurance won't cover you, or the government invents new levies and taxes to meet their budget. We've had quite a few close shaves, because we planned to see how much of that $50K we could spend.

Most of the changes you need to make WILL be a shock. You will feel like it won't be possible, you will cheat and revert, haven't we all! The main thing is to remember your focus. Mine, is to focus on the baby. It will probably be my last, so I don't want the pursuit of things (and the financial burden of that) getting in the way. If you remember your focus after falling off the wagon, it's easier to get back on again.

My husband and I have worked for years, to get the quality of life where he isn't laboured with long, unreasonable hours so we can all enjoy family time at home. If it's taken us years to control how much is enough, then it may not happen overnight for you. But stay focused and remember why you want to do this.

With regard to breastfeeding, I was lucky enough to successfully breastfeed and was able to manage it extremely well, which meant I didn't need formula, bottles or breast pumps. However after seeing my sister in law struggle my advice is to be calm, try not to let things stress you and remember the first few months really should be for you and your baby. If your feeling tired it's okay if the floors don't get swept that day. Don't go out every day shopping or for coffee with your friends. Your body needs time to produce the milk for your baby, the more active you are the less milk you will have for your baby. It seems with my SIL she doesn't want to be bored at home all day, but I think you should enjoy this time it truely doesn't last long enough. Everything in moderation.

ReplyDeleteKathy

Nothing can prepare you for a new baby, all the advice, all the reading, nothing. It will change your life completely, you'll be flabbergasted! My advice, breastfeed, yes, it's free. And you don't need all that baby paraphernalia they have these days, not even a cot if you can't get one secondhand/for free, you can use an old drawer from a chest for the first few months. There's too much emphasis these days on stuff that you 'need' for a baby. All you actually 'need' is time and energy!

ReplyDeletei would think the $200 sanity money should be the first thing to go! perhaps a change of mindset is what's needed? why do you need $200 week to stay sane? perhaps you could learn to stop spending and enjoy things that don't cost money! money does not have to = fun!

ReplyDeleteinstead of going to coffee/lunch etc dates with friends- why not meet at the local park/botanical gardens/walking route and walk'n'talk? it's free and fun (and good for losing pregnancy weight)... instead of walking around the shops where you'll be tempted to buy things, walk around the library, where you can borrow books/dvds/cds etc to your heart's content for nothing! invite your friends over for a board games night or a dvd night instead of going out somewhere $$...

plant a herb garden- it is one of the best ways to stop spending money on herbs and maybe grow a few of your own veges- even a potplant filled with lettuce will save you money if you eat salads!

buy only the essentials for the baby and wait to see if you really need anything else... just by waiting, you will work out what you really need and what is a waste of money...

good luck! having a baby is such a huge change in your life- enjoy it!

leah

This is a brilliant discussion. My little ones are nearly 3, a little over 1 and the third one is due in May. A few things to add, make it very clear that you prefer second hand then everyone will keep their eyes open for clothes/toys at the op shops or garage sales. This means making do with clothes that are a bit too big or a little tight until some new (for you) ones make it to you instead of quickly grabbing that cute outfit at the shops. Find friends or friends of friends with older kids and look though dusty stored away boxes of clothes ... Great treasures to be found. Also if you live in a hot climate think about delaying switching on the air con until its really really hot my first baby came home at 43 degrees and lives just in nappies for the first few months all those cute clothes were too small for her before it started to cool down but you'll get used to the heat and babies are tougher than you think...

ReplyDeleteDetermine the kind of lifestyle you want. Are you 'wired' to stay at home, do you love the income, status, title of being employed? I have a balance in my life and work 2 days a week, which keeps me in the workplace, and keeps my skills and experience up, and I enjoy a reasonable income, which certainly makes a difference. Be guided by your core values. You may thrive on parenting, or you may prefer working.

ReplyDeleteMy main suggestion to you is to set up fortnightly deductions from your wage to cover main living expenses such as utilities, and rates.Shop around for utility providers. Seek out a financial Counsellor for useful suggestions/ options. If unexpected things happen it is possible to negotiate loan repayments to cover these times.

We live in an affluent society, and are very blessed. We don't need everything that opens and shuts.If you have the space, grow fruit trees and stew and freeze, or dry for later use. Line dry washing, using a cold cycle. Whatever happens, communicate with your partner and include him in the budgeting.

Hello Rhonda,

ReplyDeleteFirstly, congratuations to 'Jack and Jill' - a precious little baby is news of the BEST kind! My husband and I have 8 beautiful children, ranging in ages from 16 years down to 19 months. We are a single income family - my husband actually works part time (due to illness); and his salary is less than 'Jack's'. I would consider that we still have more than we need. We are happy, healthy, well fed and well clothed. Yes, we need to spend our money wisely; but there is SO much that little ones do not need. We have made decisions that allow us to live within our means; it definitely takes a change in attitude (and it has to happen step by step), but it CAN be done.

Some thoughts and things that have helped me :

* Being at home with my children is not an interruption to my life, it IS my life during this season. My life is not 'on hold' till the children grow up; this is my life here and now - and it's wonderfully rich and rewarding!

* Budget - not for what we think we 'need', but according to what we actually have to spend. Whittle away as

much as possible to enable you to stay within your means (eg. the $200/wk pocket money). This may mean looking at where you live (eg. choosing a more modest home), and for us includes shopping second hand for most things (by looking around there are so many bargains to be found - just don't compromise when it comes to safety standards). Pay cash for as much as possible - you can actually 'see' where the money is going (this alone made a huge difference to our housekeeping budget).

* Learning to cook from scratch and garden make a huge difference too - but if you're not already doing this it will take time and effort to learn (and with a new little one you will be tired at first). Find someone to come alongside and teach/help you; take it step by step, give yourself permission to make mistakes and don't give up - ever.

You will be surprised how your little one changes your lives - in the most rewarding, fulfilling ways. So, so worth it.

Rebecca.

Very exciting news for you Jill. Everyone has given lots of good advice already, but one thing I would say is that you may be surprised to find that you do spend less when baby arrives. For example, you won't have the cost of clothes/grooming for work, take away coffees & lunches, transport to work etc. Plus you probably won't have much time to wander around the shops or go out for lunches with friends. When I was pregnant, my husband was studying and I was the one working full-time to support us. When baby was born, we lived on our savings plus Centrelink (about $180/week + baby bonus) for 6 months before hubby finished his studies and commenced work. I was a bit stressed beforehand that we would survive, but we did, with quite a bit of savings remaining! So take heart - it definitely is possible and you will find your own way to do it. I would utilise the excellent advice people have given too! It would be great to start trying to live on one wage now, as these adjustments do take time. Good luck - I'm sure it will all work out brilliantly!

ReplyDeleteWe had 5 children and I have largely been at home during the last 21 years of parenting. Top tips (in no particular order) are:

ReplyDelete- learn to live on one income NOW and use your income to pay off debt or build an emergency fund for when you are home and not earning.

- shop at thrift stores for clothing (or ask for hand me downs from those you know)

- get on the freecycle network as almost anything you will ever need in life (other than food and shelter) is on there for free. Give back to that network when you have something you no longer need.

- get out of debt asap then put down extra money on your mortgage (if you have one)

- pay cash for everything

- maintain what you own so it won't need repairing/replacing

- consider getting rid of a second car (if you have one)

- eat simple whole grain foods that are IN SEASON in your area

- buy those in season items in bulk (cheaply) at the end of that season and freeze or can them for off season eating

- grow what you can to offset your food bill. Plant food producing trees, plants and bushes instead of only ornamentals

- try to learn a new home making skill each week in order to increase your sill set (sewing, knitting, bread making, making cleaners, etc)

- eliminate all unnecessary expenses now (cable tv, extra cell phone, eating out, take away coffee, any other extras)

- take up some hobbies in your home that are relaxing and enjoyable and don't cost a lot of money

- learn to slow down and enjoy the REAL moments in life - the ones that bring happiness but don't cost a penny (a garden, a comfortable home, family, friends, etc.)

- learn to stock up on staples bought at the lowest SALE PRICES (buy enough of that staple when it is at the lowest possible price to last you for a few months or until it will go on sale again). In this way, you will slowly build a pantry inexpensively which saves money as long as you buy only what you WILL eat or use within a few months.

- reduce utility bills by simply using less of them. Be mindful.

- if you eat meat, stretch it in your cooking by adding healthy legumes and pulses to the meal

- stop looking at advertisements - simply recycle the flyers before you open them (except for food flyers)

- stay out of the shops. Browsing leads to wanting things you didn't even know existed and likely don't need.

Remember the golden rule:

"Comparison ruins contentment"

It's easy to compare a frugal, simple lifestyle to an affluent way of life and feel somehow deprived (at times). Always remember that true (and lasting) contentment comes from the satisfaction of living a meaningful life true to your values and your heart.

Enjoy the rest of your pregnancy :)

I think that the the thing that helped my husband and me most of all when we were expecting our first baby (and thereafter) was to set our number one, very top priority: that I would be the "stay-at-home" parent and that our children would not be placed in daycare, period.

ReplyDeleteAfter that, we just did whatever needed to be done to meet that goal. It was NEVER a question of "if" we could afford to have me stay home but rather a question of "how" we would accomplish it. (Deciding to be a grown-up helps immensely as well - cooperate together, both working hard, and no complaining!)

My income at the time made up just slightly more than 50% of our annual income, so it was certainly not an insignificant change for us! And it was not always easy, either. I had to give up things I was used to but I also found that there were less expensive ways to get most of what I wanted anyway.

I had to stop shopping for lots of pretty (and pretty expensive) clothing but then found ways to still look stylish without spending so much.

We cut way back on restaurant meals, but found we were actually eating much better and enjoying it more when we cooked at home.

My children looked as cute in their adorable little outfits as any other baby, and they had as many toys as most other kids (in other words: TOO MANY!)but I tapped into the used/free market and paid either nothing or pennies on the dollar for the same thing other parents paid full price for.

We moved to a small fixer-upper, and we still live there, but over the years, with many do-it-youself house and garden projects, we have created here a true home we all love. (I can't overstate the numerous benefits to living in a smaller house rather than some "McMansion!")

I breastfed, used cloth diapers, baked and cooked from scratch, shopped at yard sales, conserved energy, walked instead of drove (good way to lose the extra pregnancy weight)and did a hundred different things to save money so I could be there with my precious babies. It has been by far the very best decision I have ever made!

And I will point out that the vast majority of what you can do to save money will also help to save the planet so all our precious children can keep living and breathing on it!

Most people who make the commitment to living on one income experience this kind of awakening - that living with less is actually much preferable! There are hundreds of books, websites, and other resources to learn from; I think Down To Earth is literally the best out there.

So - if your top priority really is that there will always be a parent caring for your baby, the place to start is to make that decision and go on from there. Put your hearts and minds together and figure out how to to make it work for your family.

How wonderful! Babies don't have to be expensive - we have eight children and a modest income. Our biggest baby related savings are nursing and cloth diapers. If those two things are possible lots of money is saved. And lots of rest for mama is important. I suggest filling the freezer with casseroles (if you like them)and baked bread so that the busy days ahead can be enjoyed without the temptation of eating out.

ReplyDeleteMost of all, treasure the moments - they pass by all too quickly indeed. :)

We are semi-empty nesters (they seem to bounce back on bungey cords) but I raised 4 on a single woman's budget(nurse) The Mortgage: my husband and I received one of the new Affordable Home Mortgages last year for our farm( Our mortgage is now 2% interest which will top off at 4 % in 5 yrs, if the national rate is higher than 2. Food: I never had a weight problem while raising kids. We had enough, but no extra and that was actually more healthy than not. If you cannot garden on your lot then google community gardens in your area. Around here their dues are $25/yr and you can grow a ton of food on that while tapping into the wisdom of more experienced gardeners and baby will learn to garden alongside of you. Tithing: just do it. It's good for the church and soul (and who wants to fool with their soul)and selfishly thinking, what goes around comes around. Baby stuff: if you do not sew, learn how. either via a class or the many sewing sites on the computer. Fabric from Walmart, internet, or recycling big clothes as well as linens from home and yard sales. the search for fabric is fun and can be addictive(warning there! lol). Just last week my husband came home with yard sale fabric for me (and he is frugal beyond belief,). Clothes, toys, furniture, tons out there at yard sales and on Craigs list. Just plan your search carefully, the gas money adds up. Go to mom and baby play groups, there are many in churches and libraries and other moms are full of cost cutting ideas. I also had a couple of boys I babysat and my kids loved them, as did I. we were lucky, it doesn't always work as well but it did for us and gave me extra grocery money.I have never had the amount of money your husband makes but my family lacked for nothing including music and dance lessons as well as scouts and 4-H and church activities and summer camp.Internet: I have found that to be vital. I am home, I need to link up with outsiders for my sanity, pay bills, learn new skills. I learned to can by on line sites. Food preservation: learn canning from a person or on line. Make sure what you do is safe, check with gov sites and cooperative extension sites. also get The Encycloperia of Country Living, by Emerson, bless her soul. tons of teaching in that with a sense of humor. TV/Cable: I did now have it when the kids were growing up, only have it now to entertain my senile mom who lives with us. when she passes on, so will the cable. Make a list of things you really want for the baby shower, family and friends can combine money and get you what you want. Kids don't need the fanciest models of things, but you want safe reliable equipment that will hold up to whatever your lifestyle takes it. Think ahead on this: We planned to take our family camping so I wanted a portacrib and baby carrier for hiking, a tent and good sleeping bags (and with these you can always afford a fun vacation!)and they were all used to death. Let hunting friends know you are interested in what they kill, if you eat meat. we get a deer every year from a hunting friend, organic meat of course. I haven't found coupons to be helpful since most of them are for things I don't buy anyway. when I read stories about "Coupon Queens" etc. I am shocked at the garbage they get that they consider to be a good thing. My kids were in cloth diapers (as are my grandchildren interestingly), baby wipes were clean cloths, and we use cloth napkins at meals that I make. I still buy paper towels for cleaning up things i do not want to have to wash later, like something coming out of a pet(!). Anyway, the entire family budgeting was a project that I always embraced as a challenge and as the kids grew up it served to impart a great many values.Enjoy the journey!

ReplyDeletei am shocked that jill and her husband will find it difficult to survive on that amount of money

ReplyDeletei am 30 and a pensioner and i can tell you my annual wage is almost a fifth of this and i live comfortably, frugally but contently.

its a sad thing in society that people feel the need for "sanity" money.

money can not be converted to happiness!

im not trying to be negative but that sentence regarding $200 each just grated on my nerves.

how and what are they spending this money on? if they have so much to spend on non essentials they certainly have plenty to raise a few children and put away 10% for savings.

theres no mystery to being able to afford things with that amount of income, its just a little common sense.

The $200 sanity money was shared between them, not $200 each. I think it's commendable they're asking for advice and are looking forward to raising a family while earning less.

DeleteMy little one is 3 months old and we are in a very similar position to Jack and Jill (although my husband earns slightly less then Jack), having suddenly dropped from a very good double income to only one, but we still tithe 10% and we are putting aside money into our mortgage and savings. My advice would be:

ReplyDeleteBudget! As other people have said, work out how much you spend each week on the essentials so then you know how much you have to play with out of Jack's income.

You won't use $200 a week in pocket money once the baby comes along! I have found that I spend barely anything anymore because I am at home. I don't buy lunch and I'm not spending my lunch hour at the mall, so the temptation to spend has been removed. And dinners out? You can pretty much forget about them...some things are just not that easy anymore (for the first little while anyway!).

Cloth nappies! I was skeptical at first, but got some anyway, and now I'm in love with them! I use itti bitti tuttos - it cost me $400-500 to get started, and they will fit baby until he's out of nappies, and if you're planning on having more then one, it's definitely worth it.

Don't spend money on baby clothes (you'll get given a heap anyway). They really do only wear them a few times before they grow out of them, and Big W, Best and Less and Target all sell really cute, cheap baby outfits. Try and go to a Baby and Kids market if they have them where you are for second-hand clothes and toys (we picked up a barely-used activity mat for $15 whereas new they are $100).

My other advice would be this: don't expect that as soon as you become a "stay-at-home mum" you'll be able to start a veggie garden, make all your meals from scratch, bake bread etc unless you're doing all of that already. I completely underestimated the time a little baby would take up, and believe me, they take up a LOT of time! Start slow (I'm only just managing to keep the house semi-clean, and it's been 3 months!). But it's so completely worth every minute so just enjoy your new little one and relax.

Congratulations Jill. I think many of the things you are concerned about will simply fall into place if you start out with the right mindset. For me it was making gradual changes and not expecting too much from myself in the beginning. I stay at home with my almost 3yo son and my husband earns about the same as yours. Our mortgage payments are $1700 a month currently and we do just fine on the rest. Should you choose to breast feed but things not work out do consider investing in a lactation consultant, for me this was invaluable. But I think the main thing is to just focus on your and baby's well being and then make small changes as you can. When my son was a few months old I started using cloth nappies during the day, disposables at night. I didn't do much vege growing in the first year but now I have more time I do grow easy things like herbs, silverbeet, lettuce, beans and tomatoes. I try to shop at the local markets for everything else and just do a small grocery shop at the supermarket for other essentials. We are able to save money most months and we get the family tax benefit paid annually which is a great top-up for our savings! If we had it paid fortnightly I think we would just spend it. We still eat really well, and have nice clothes etc, but anything "big ticket" usually has to be saved for or requested for birthday/Xmas. I love designer clothes so usually request those ; )

ReplyDeleteRhonda's blog has really helped me, not just in budgeting, but in making the mental transition from a working professional to a home maker who takes pride in my new, very important work. My husband is really happy as well, and we are enjoying this time while it lasts. This transition took time though and in the beginning it was really hard to be honest. But its so worth it.

I would urge you to to get hold of a copy of Rhonda's book, it is full of amazing advice and is very motivating without being preachy. But read it before baby arrives as once he/she is here there won't be any time! All the best, Dot

Hi there

ReplyDeleteI dont normally comment but I thought I would in this case as Jill's situation is very similar to what we are currently going through with our first child. Our initial plan was to start trying for a baby and whilst we do that we live off one wage as practice. Thinking it would take six months or so. We were fortunate that it happened straight away which meant we had to go into reduced spending mode straight away. So i thought I would just dot point a few things that we did/are doing. So i hope they help.

My husband earns just over $50,000 per year and I was able to have paid maternity leave for 28 weeks (not the government one) . We did the math and we are able to live off my husbands wage, and anything that comes up that is expensive we will have to save for. but thats fine by me.

I use cloth nappies for the most part which helps with our costs.

Most of our big purchases we got our families to buy for us.

I say yes to all hand me downs- with the disclaimer line of "if i dont need this anymore etc do you mind if i pay it forward or donate it"

Anything that you buy or get given that can be used for the next baby buy in a neutral colour. I have all white sheets, wraps, singlets, socks, blankets, towels etc etc. Also dont be afraid to return or exchange stuff. THe less gender specific the better for your budget.

I believe in investing to. So i did my research on things like breast pumps, bottles, highchairs etc and bought things that were middle of the range but that I know will last. The bottle/feeding system that I bought is all interchangeable and makes things a lot less complicated and cheaper.

Look on eBay for things/products that you will need. I bought my highchair on eBay and got my sister to pick it up.

Sew and make things yourself or ask a friend or future grandma to do it for you. The handmade things are what I treasure the most.

Food wise I have found that our food budget has gone way way down. I am home and semi organised so if I see that some vegetables are looking a little old I can make a stew or soup. I am able to make my husbands lunch or give him left overs and because neither of us are popping down the street to grab something quick and expensive for lunch it has saved us heaps. I have started to buy things that we use often in bulk, pasta, tinned tomatoes and tuna and some weeks only have to buy dairy and fresh produce. I also know exactly what is in my freezer and can quickly make something or pull out some leftovers.

So these were just a few things that we are doing that are working for us. I am sure i have forgotten many. Hope they help.

All the best :)

Congratulations firstly on baby and then your foresight to be thinking ahead like this theres alot of people out there who don't. I would recommend cloth nappies i use www.greenkids.com.au and they are fantastic i even got some second hand from a friend and they are still going strong after 5 years of our combined use. We have disposables as emergency back up when needed and don't beat ourselves up about it if we need them but it has saved us up to $80 month after the initial outlay. Exciting times ahead enjoy every moment. Happy Journey

ReplyDeleteFunny thing about having a baby is that the lifestyle change is a natural one. We ate out 2-4 times per week as a married couple, but due to fatigue and the effort it takes to go out with a lil one we ate in more, we didn't want to hire sitters because we couldn't bear to leave him behind in that first year (also could not imagine who would be trustworthy enough!) Your mind will also think of your spending money in terms of how it affects your child. 20.00 for a dinner? Or new clothes, diapers, food for baby. Your choice will be a no brainer for you, trust me! I personally feel silly with all the research and laboring over baby stuff to add to my list of things I thought I "needed" to have at the moment my baby was born. I didn't. In reflecting on my best purchases made after my baby was born (2 years ago) I came up with this list.

ReplyDeleteExtra set of bedsheets (for my bed I only had 1)

2 pair of PJ's (for me to LIVE in postpartum)

A good cloth diapering kit setup in an area of your house

Breastfeeding support (Postpartum Doula, Lactation Consultant)

Baby sling/carrier

Inexpensive bouncy seat (preferably without toys)

Electric bread machine (Set it to bake overnight-fresh bread is welcome if you yourself have not slept!)

Place for baby to sleep - (My bed for many many months!)

Carseat

Small Diaper bag with smart storage, that does not require hands to hold it

Really good camera

That is it! Let people gift you clothes, toys, books, everything else because you will go thru them like crazy and then they grow to different needs. I am now in love with our local library, childrens museum, thrift and consignment stores and sales, and know where all our parks are! Our income was cut by %50 when I had our baby. I now work from home part time which is used to purchase groceries and other sundries. I don't miss the money at all like I thought I would. My mindset has so changed. Yours will too, trust me. It'll be fine, and you won't regret spending those days with your child. Priceless!

I doubt that baby expenses will be the sticking point in your budget, as other posters have mentioned there are plenty of ways to set up for baby cheaply and it’s really the ongoing costs that are the concern. Baby will cost as much as you let it! It’s really the living expenses that will determine how you will manage on one income, and it’s the big, fixed expenses that matter the most – like the mortgage. From what was in the post, it looks as though there is lots of room to move with the variable expenses. This is good, it’s just a matter of learning to live well on less and questioning all your assumptions about what you spend your money on. Keep tweaking that budget and things will come together if you are committed to it.

ReplyDeleteAs for the grocery budget, I think my husband and I eat pretty well (although not organically) on about $150 a week. I know we could do better if we were more organised. We cook from scratch and bulk cook a lot of our commonly eaten meals. By freezing in zip lock bags we can fit a few weeks worth of meals in a normal sized freezer. As a new mum, not only will you not feel like cooking, even if your husband takes over the cooking – babies can be very demanding in the evenings and it is very handy knowing you can have a meal ready in 15 minutes, this will reduce the temptation to get takeaway. Another bonus is that cooking meals this way can reduce vegetable waste as the vegies are cooked and frozen as part of the meal.

Some other ideas for savings:

Does your husband have a HECS/HELP debt that you could pay off with savings? This could increase your cash flow, and provide a 10% return on your investment. This could count towards your goal of saving for the future.