WRITING UP YOUR BUDGET A budget is really a spending plan. Having a budget does not restrict you but instead it gives a feeling of freedom ...

Post a Comment

Graphic from the Carl Larsen gallery Whether you like it or not, to live a simply or green life, you must reduce your spending. It's pa...

Most people hate budgeting. I did too. I used to think that making up a budget would put restrictions on me and I didn't like the soun...

It will take at least a month to get an accurate idea of what you're spending on non-essentials. It's worthwhile putting the time a...

February, week 3 in The Simple Home The Gender Pay Gap Throughout the developed world, there is a significant difference between what m...

Hanno and I spent two hours on our budget yesterday. We checked old bills and we had our little (solar) calculator running hot. We put 2 and...

Hopefully this will be the last post about money for a while. Our budget is an important part of our simple life. It gives us a spending pl...

There's no doubt about it. Almost everyone has money problems at some time in their life. We all use the stuff, it is a requirement of m...

March, week 2 in The Simple Home This week we'll focus on shopping for food and I'm guessing that will mean vastly different thin...

Both images are by the wonderful Swedish artist Carl Larsson from here . Today I have an email from a reader who is due to have her ...

February, week 4 in The Simple Home This is the last week of our money month. I hope you've sorted out what needs to be done, organis...

Written January 2010 Getting finances organised and controlled is one of the early actions of most simple lives, even for those who ha...

I'm guessing that most of us try to live well without spending too much money. Some of us are forced via our circumstances to do it, so...

I think Hanno and I have been pretty succesful in changing our lives from one of stress, expense and disorder, to a life of relaxed content...

Getting finances organised and controlled is one of the early actions of most simple lives, even for those who have no need to budget their ...

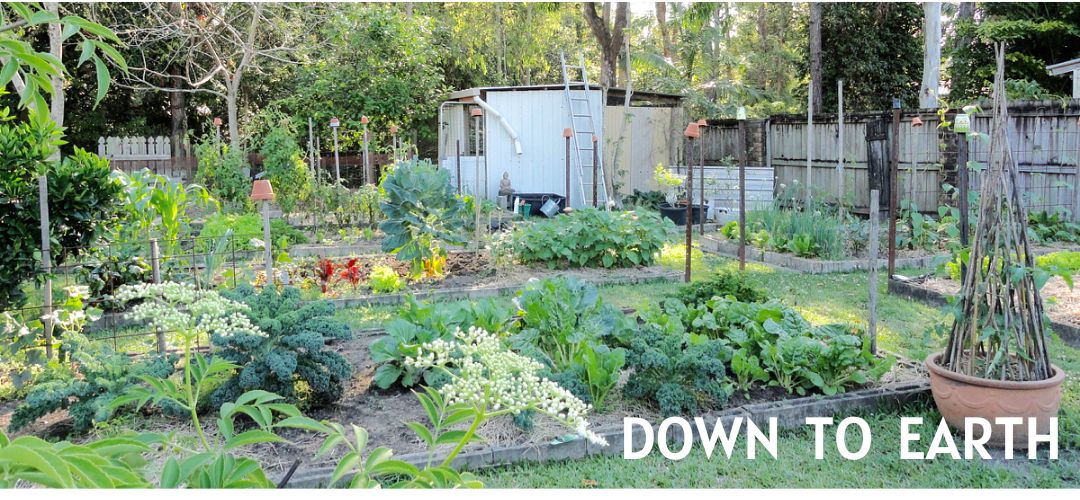

Hanno asked me to thank you all for the lovely birthday wishes sent his way on the weekend. He is 69 now, the last year of his boyhood. N...

Subscribe to:

Posts (Atom)