I've never seen financial conditions like those we have now. The cost of living is increasing in Australia, I'm affected by it and I'm guessing you are too. I'm in the good position of being debt-free, we paid our home off many years ago but I still have to watch every penny.

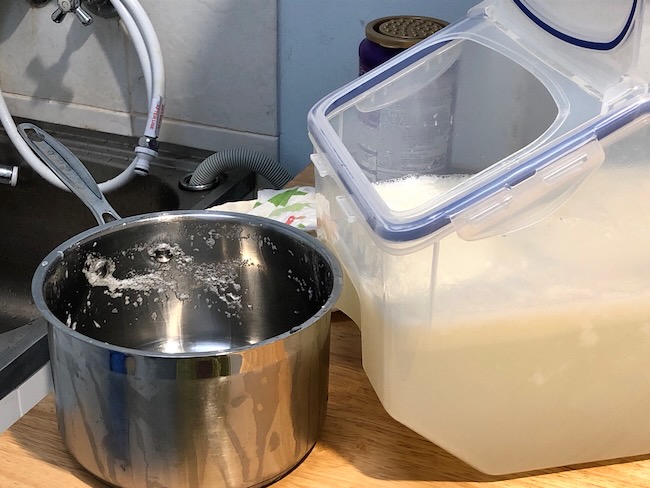

Make your own laundry liquid and cleaners - it will will save you an extraordinary amount of money.

Hanno and I have lived on a pension for some years and we built a nest egg that provided a feeling of security but when he died, that changed. I went from a couples pension to a single pension which is more money but when you calculate all the goods and services over the course of a year, the single pension doesn't look so good. I've spent the past six months learning what needs to be paid and when, and I'm also paying small amounts frequently on the large bills like rates and car registration, instead of being hit with a big bill every six months.

Hanno always organised our finances and he was very good at it. So, I turned my back on all of it and lived in that oblivious state for over 40 years. When he got sick, the last bills he paid were in November and I didn't even think about paying bills until four months later, when they were overdue! When I looked in his email account, there they all were, waiting for me like a ton of bricks. I should have know exactly what he was doing, I should have shared that role with him and had I done that I might be in a better financial state than I am right now.

When Hanno was in hospital, there were no expenses - everything was covered and we had private health insurance for the extras. But before he went to hospital, when I was looking after him at home, I bought a number of high priced items - wheelchair, walker, bed rails and incontinence items. He also had speech therapy for swallowing and physiotherapy for walking. We paid for all of that while he was at home even though we had a level 4 home care plan. That plan looked good when he got it but the funds dribbled in and it was eaten up with services - people coming to help shower him etc., and there was never enough money to buy the equipment he needed.

To make a long story short, now that I look back on the past six months, I realise I should have been aware of my financial position much sooner. Had I been sharing that work, I would have been. However, now the nest egg has decreased a lot and with the cost of living higher than ever before, I'm trying to stretch dollars. As you know, we got our finances in shape by stockpiling groceries, cooking from scratch, growing food in the backyard, monitoring our electricity and water. We stopped TV we had to pay for and buying magazines, drinks and lunches when we went out. I've already done all the big changes, now it's down to the list below. The steps are small but they're all worth doing and like buying a cup of coffee every time you go out and realising that cost adds up to hundred of dollars a year. Stopping those small things to save money takes time too but it's really worth it.

Mend and make do.

I'm lucky, I don't have to pay rent or a mortgage, we paid that off, in eight years, a long time ago. But interest rates are rising now after being low for many years and that is hurting a lot of people and for some, it's not sustainable. If you're in that situation, I urge you to hold on and start working on these lists below. Times will be tough for you, you'll have to stop buying your favourite things, stop holidays and stop shopping without your budget in mind. You will have to sacrifice to survive.

If you don't have a budget, go to https://moneysmart.gov.au/budgeting/budget-planner now. It’s the Australia government's site which holds a lot of useful information about debt, mortgage repayments and budgets. Forget the freedom of spending in the past, think of the future and how you can save your home. It will be hard but most of you will be able to do it. And don't forget to talk to your bank to find out how you might be able to reduce your payments for the time being. You'll have to make up for it later when things return to normal - and they will - but that one thing may help you keep your home.

In times like these you should be mindful of everything you do that will save money. Try to cut back on the amount you will have to pay in utility bills and for transport. That money is much better in your pocket than profits for Energex, Telstra or Shell. So let’s go through a few things you can do to keep money in your pocket.

ELECTRICITY

- Use your electrical appliances like washing machines, vacuum cleaners, dishwashers in off-peak times. Phone your electricity provider and ask if you have peak times and when they are.

- If you have solar panels, use your appliances as soon as the sun hits the roof - that way you'll use the solar power you generate instead of buying from the grid.

- Wash your clothes in cold water and dry them outside in the sun. I always wash in cold water using homemade laundry liquid and our clothes look fine. Over the years, this has saved us hundreds of dollars.

- Use compact fluorescent light bulbs. Fluorescent bulbs are more efficient than traditional bulbs. A 60-watt fluorescent bulb has the same lighting capability as a standard 75-watt bulb and it will last for years. Light bulb buyers guide.

- Turn off the lights when you leave a room.

- Turn off the TV when no one is watching it.

- Turn off appliances at the power point, not just at the appliance on/off button.

- Fill the kettle with just enough water for your tea or coffee. Boiling water you won’t use, is an expensive waste. If there is hot water left over, pour it into a thermos flask and use that for your tea or coffee during the day.

- Buy a power board and plug in all the appliances you have close together into that one power board. When they aren’t being used, and especially at night, turn off the power board. That will stop all those appliances using stand-by power. It is estimated that 10 percent of the power used in Australia is for appliances on stand-by.

- When you boil food, either on a gas or electric cooktop, put the lid on your saucepans because it retains heat. Your food will come to the boil faster, and then you can turn the power down to cook on a simmer.

If you can, grow food in the backyard - or in containers.

WATER

- Fill a bowl with water to wash vegetables. Letting the tap run while you wash wastes litres of water.

- While you’re waiting for the shower water to warm up, fill a bucket with the cold water and use it on your garden or in the washing machine (top loader only).

- Have shorter showers.

- Turn the tap off when brushing teeth.

- Flush the toilet only when necessary.

- When washing your hands, wet your hands, turn the tap off, apply soap and lather, turn the tap on again to rinse.

- Install water tanks if you have a vegetable garden, or at least set up some water barrels at the down pipes to catch what rainwater you can.

COOKING

- Cook larger portions of food and freeze the leftovers for use on other days. This will enable you to cook meals for more than one day and use only the electricity to warm the food again.

- When you boil something on the stove, bring it up to the boil, then turn it down to a fast simmer.

- When boiling on the stove, always keep the lid on the saucepan. This reduces the time it takes to come to the boil.

- If you’re using your oven, cook more than one thing.

- If you’re baking bread, do more than one loaf and freeze a couple of loaves for later.

- If you have a small convection oven, use that instead of your large oven.

If you have a small convection oven, use that instead of your larger oven.

PHONE

- If you're not on the cheapest plan right now, do some research to find out what you can do to reduce your phone costs.

- If you're on a contract, never let your contract go from one year to the next without negotiating a better deal with your phone company.

- While you’re saving, use the phone only when absolutely necessary. Stay in touch with your friends online instead.

- Use Skype or Zoom for your long distance calls. Make sure you download the right version for your equipment - there are versions for Apple phones, ipads and computers as well as for Android smartphones and computers.

TRANSPORT

- Plan your trips so you're not using the car to go to one place. Work out what you have to do and plan your trip going to multiple places to use the least amount of petrol.

- If you have to take the children to school – share that with other parents in your neighbourhood. Even if you share with your next door neighbour so that you take them and she/he picks them up, it will halve your school trips.

- Start a walking bus. Parents take it in turns to take a group of children to school by walking with them.

- Download the motormouth app to find the cheapest petrol in your area.

- If you run a business, make sure you keep a diary of your business and private car expenses so you can claim what you're entitled to at tax time.

REGULAR BILLS

- At least once a year, look at the details of all your regular bills. Bills such as phone, internet, electricity, phone and insurance should all be checked. Ring up the opposition and ask what they would charge you for the same service. When you have a good idea, phone the company you deal with and tell them you could get a better deal with a rival – and tell them the company name. Say you’re ringing to ask if they can equal or better that because you’d rather stay, but as you’re on a tight budget you must go with the best deal. Often this pays off and it should become part of your financial practice each year to test these boundaries.

This is one of our old gardens. We were vegetarians then and we grew most of the food we ate.

GENERALLY THERE ARE A FEW WAYS TO CUT BACK.

- Separate your wants from your needs and be firm with this.

- Ask yourself if you really need it.

- If you do need it, can you barter something for it instead of spending money? Bartering used to be quite a common way of obtaining goods in small communities. Ask around, you’ll probably find people who are keen to barter. See if your neighbours or work colleagues are interested in bartering.

- If you can’t do without it and can’t barter for it, can you make it yourself? One of the skills you’ll develop in your simple life will be to hand-make many things from food to clothes. Maybe you could learn to make what you want.

Try to live on less than you earn. If you can't do that, you'll be paying off debt all your life. But now in these current difficult times, with high interest rates, unemployment, increasing food and fuel prices, there ARE things you can do to reduce your expenses. This won't last forever but it will last a few years. So if you start helping yourself, following a budget and reducing costs, you'll come out of it in reasonable shape, and hopefully still living in your own home. How are you tackling this problem, please share what you're doing and we might all learn something. I wish you all the best of luck, Now, let's get to work and start reducing our expenses.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

54 Comments

Hi Rhonda

ReplyDeleteI never used to check for a better deal on house insurance, I just paid the yearly renewal. Then I noticed the cost of the replacement I was paying for would have built multi-storey mansion when I live in a small 3 bed weatherboard home. I rang up and dropped my costs by a third. From $1300 to $500ish 5 yrs ago. I now check everything, better late than never. Take care. Cheers

Lucky you noticed that. It’s always worth checking.

DeleteMmmm my user name didn't attach Bernie here😁. I will have to check it out. All good information to make us review and optimise our costs. Cheers

DeleteYou have written a very beneficial post Rhonda. As retirees, we are trying to encourage a system of bartering with our friends, sharing excess fruit and vegetables that we grow etc. Always cooking from scratch and freezing the excess. I think people who have access to a nearby farmer's market are also way ahead, as long as they are savvy and buy from the local grower, not a company who has set themselves up at the market to appear local. I grew up with my widowed mother, so have an understanding of the challenges involved for you. It's lovely to read your post, and I hope you are well. Warm wishes, Pauline

ReplyDeleteBartering and sharing is a great way to save money and build community. Well done, Pauline.

DeleteAll such good points and ways to save money. Until I started doing these things eight years ago (after reading Down To Earth during a hospital stay) I hadn’t realised just how big a difference they make. Along with a couple of local friends we also car pool to the shops as it is a half hour drive away. We organise to do our shopping on the same day and save fuel money by going with each other. We plan our vegetable garden crops so we all grow different things and then share the produce. If on Facebook or able to download the app there is also a worldwide project called “The Buy Nothing Project”. This is comprised of hyper local groups in which it is a gifting economy. Instead of buying something when you need it ask in your local group, quite often you find someone has it and is willing to gift it to you. It’s also a place where you can gift things you no longer need to people who will use it. The aim is to reduce consumerism, recycle, reduce landfill and perhaps most importantly, foster strong community ties. For example, I broke my milk jug (I drink plant based *milk*) and rather than spending the fuel to drive half an hour each way to the shops and then the $5 at Kmart to buy a new one I asked if anyone had a jug they didn’t need on my local group. Within an hour a lady had gifted me one and even dropped it at my home as she was driving past. For the past 18 months I haven’t bought anything new, all my clothes that I needed when starting a new job or other things I needed around my home have been gifted to me, in return I have been able to declutter my house and help others out. I’ve forged some wonderful friendships and have been gifted peoples time with them coming to help me with my large garden. I often pot up self seeded vegetables and put them out the front of my house for people to take and once in a while I come home to gifts of produce, flowers or even the odd bag of potting mix left in their place. The gift of community can not be underestimated as a way of saving money in ways you never imagined.

ReplyDeleteAnother fantastic community initiative that works well and saves a lot of money.

DeleteThis is great advice for those struggling Rhonda. It is always good to have reminders like this to encourage others how to save money. We are now debt free so hopefully life will okay for us. I am still growing our fruit and veggies and bartering with them when I have excess. We are vegetarian but I still notice our food bill is rising every time I enter a shop. I try and stay home as much as possible to avoid spending. Earlier on, I gathered quite a good stockpile together while the prices were still reasonable.

ReplyDeleteEven though we are debt free, I am still frugal with our finances and way of life, and will continue to be. Thanks you for all the helpful advice through the years since I found your amazing blog back in 2007. I learned so much from you and that has helped us become free of debt, which is a bonus as retirement is looming in the next five years or so.

Have a wonderful weekend,

xTania

It sounds like you're living very much as I do, Tania. Keep up the good work. xx

DeleteThanks for this post Rhonda. I'm glad you've got your finances back on track. I deal with all our finances (I'm the wage earner in our household) but your experience has made me think that I should share this with my husband. The cost of living in the UK is ridiculous, they were predicting energy bills of over £5000 per year but the government has now acted and they are capped at half that. That's still an extraordinary amount. In our family we live on only my income. I'll be trying to incorporate all of your suggestions into our life. Like a lot of UK houses, our house is very poorly insulated and draughty so whilst we can't afford to have it insulated, my plan is to try and find thicker curtains in charity shops and also to make some curtains to cover the doors. We are also planning to hold out for as long as possible before turning on the heating and will turn our thermostat down by at least one degree as apparently this can make a big difference. Your mantra of buying ingredients and not products has helped me keep the grocery shopping bill down too so thank you!

ReplyDeleteIt sounds like you're doing well and looking for unusual solutions for your particular problems. That's great and it's something I always try to do. Yes, you should involve your husband in the money side of things. I wish I'd done it decades ago. xx

DeleteAll great tips Rhonda. My phone [I'm always about 5 iPhones behind on purpose] came off plan in May this year and I bought a Kogan Sim Card for $120 for the year and there are no other costs. With my phone off plan the actual monthly costs were $45 so went from $540 a year to $120 a year. Kogan is Vodaphone so not great if you are a rural person however as I'm in Brisbane it's perfect for me. As for House, Contents & Car Insurance I changed to RACQ 12 months ago to get a better deal. This year between the policies it all went up $700 and I spent 30 mins on the phone with them to get a better deal and they wouldn't budge, not even $50. Due to floods etc etc. and all the money they have been paying out policies have gone up everywhere. I watched the money documentary that came out a couple of days ago on Netflix called "Get Smart with Money". It's a US doco about people who are great with money showing people how to manage, do budgets etc to be in a better position than they are now. There were 4 groups. One young 35 year old sports person who earnt a lot of money but spent a lot of money, a family with 2 kids, a girl who was working 2 waitressing jobs and not making ends meet but really wanted to be sewing and designing and painting as a career and also I think a single mum or another family. The doco covers one year and the mentors check in with them every couple of months to help them. Mr Money Mustache was one of the mentors which is how I heard about it. Have a good week. Kathy A, Brisbane

ReplyDeleteThanks for sharing what you're doing, Kathy. I'm sure it will help others reading here. xx

DeleteSo much valuable information here. Thank you for sharing your experience and wisdom. We live fairly frugally, and don't feel the least bit deprived. We rarely eat out (I prefer my own cooking anyway), shop at thrift stores (when we shop at all), we use a Berkey water filter system (instead of buying bottled water), and we have gotten rid of our cable tv. We are debt free as well and are taking measures to stay that way. It is so freeing and gives one options.

ReplyDeleteBlessings...daisy

Great work, Daisy. Keep on keeping on. xx

DeleteA wonderful post with so much info. Thank you, Rhonda. One additional note for use when trying to negotiate a rate reduction, especially with phone and TV providers is, if you've been with the same company for a longer period of time, and if you're feeling like you're getting nowhere, ask to speak with their customer loyalty or customer retention manager. Oftentimes, the first line customer service representatives you get when calling in are not authorized to make reductions. They are tasked with keeping you at the highest payment possible. But, if you ask for customer retention, they know they've got to do something to keep you. And those sales reps have the authority to provide you with discounts and reduced rates so you stay.

ReplyDeleteThanks for that, Lori. I'm sure it will help readers get the best prices. xx

DeleteYou bring up many good points, Rhonda. But let's not be too hard on yourself; when your husband was ill and at his passing and I am sure even now you were/are in a state of grieving. No one thinks of everything on time. It will all be right soon.

ReplyDeleteThank you for the terrific reminders! Trying hard to keep anxiety at bay. Taking some kind of action, no matter how small, seems to help. Every penny matters, so I've dusted off the old grocery cart and will be walking to the grocery store instead of driving. Will postpone going to the grocery store as long as possible by using up absolutely everything I already have first. Am looking into every discount available to senior citizens and seeing if I qualify for any and all government programs. Don't have a washer or dryer in my apartment, but am able to use one central to the complex. Will no longer pay $2.00 per load to dry my laundry. I'll cart it home and hang it to dry in my bedroom. Using only one lamp at a time, just enough light to illuminate whatever I'm working on. Please keep the ideas coming!

ReplyDeleteThanks very much, Rhonda, that's a really helpful message. I have started to stop drying the clothes in the dryer. I now hang them outside on the clothesline. I wash the clothes in the evening hours, then we have cheaper electricity in the Netherlands.

ReplyDeleteI want to try your cold wash. But are the clothes really clean? Sometimes I use a short program (20 minutes or 30 minutes) and a low temperature.

THANKS!!!

The clothes are clean, yes. If you have a problem stain, just add a little oxy-bleach - it's the peroxide powder bleach.

DeleteIt's going to be a hard road ahead. This week my husband and I made the decision to go back to using cash only (no electronic money where posible), so we can physically see every cent leaving our hands. Tonight was our usual "take away pizza night treat" but instead we bought a sad frozen pizza and dressed it up with extra toppings and saved ourselves $20. I've started only buying us second hand clothes and have been shocked to find we are now dressed in nicer clothes than I could ever have afforded new. Family day is now a hike or a day at the park rather than an expensive outing. And we are growing our own food again too.

ReplyDeleteWe are still going okay, but we've decided to start living as if we aren't okay because no one knows how high the pressures will go so every cent we can reduce will help. As always Rhonda you inspire us to rise to the challenge with humble determination.

I've gone back to cash too. It makes a difference. When I use a card, it doesn't feel like spending. xx

DeleteYes, it's good for both people (in a couple's situation) to know how to pay the bills. I was the bill-payer for nearly all of our marriage until less than a year ago. Then I transferred the duty to my husband and was there to watch over him & answer any questions he might have. It's been a learning experience for him and I can't imagine him having to do it because I died. As they say, when you "have to" is no way to learn something new. I'm glad you're catching on, Rhonda, out of necessity if nothing else. I'm a planner by nature so it's always in the back of mind "What's going to happen if there's only one of us, instead of two.". But not everyone is like that. ~Andrea xoxo

ReplyDeleteI miss knitting in your list, to knit your socks or dishcloth can help also

ReplyDeleteYou are an amazing resource.

ReplyDeleteSo much good advice here, thank you.

ReplyDeleteJust want to say that your readers from the USA may not understand how higher mortgage rates have really hit people in Australia and some other countries. In the US we are used to having fixed rate mortgages. It stays at the same rate even if rates go up for new mortgages. In Australia, most mortgages go up when there is any govt. increase of the rate and there can be a big jump in monthly payments expected.

ReplyDeleteThat's right, although we can apply for fixed mortgage rates and many people do that. It's not just mortgage rates that have been hit though. The general price rises we're seeing in supermarkets and for clothes and school supplies etc. are all increased, in part, because of the raised interest rates.

DeleteThank you so much for such an informative post, Rhonda. I have loved reading through the comments as well. Everyone has such good tips. We are okay financially as we have always lived simply but I really feel for our children (17, 20 and 22) who are unable to afford to move out and start their own lives or even find a place to rent with the housing shortage. We are lucky to enjoy their beautiful company for a few years longer although I am not sure they would agree!

ReplyDeleteI very rarely comment, but I have enjoyed your blog for a long time and was very saddened when I read of your husband's illness and passing and even though we are strangers you have often been in my thoughts. Thank you for always being so kind and generous with your time and knowledge. Xx

Thank you so much for sharing your wisdom and advice over the years. I’m probably your age and have been living frugally all my adult life and am still learning. Part of my retirement plan was to pay off my mortgage. I was able to do that in thirteen years. I think your advice to discern the difference between wants and needs is key to getting finances under control, and it is so rewarding and freeing to live debt free! I also want to put in a plug for LED bulbs. They are 80-90% more efficient than incandescent bulbs and have a long life. They may be more expensive, but do save money in the long run.

ReplyDeleteHi Rhonda. In our house I manage the finances and I just told my hubby the predicament you found yourself in but assured him I have a list of bills he needs to pay if the time comes and I am incapacitated before him. I still get hard copies of most bills sent for his sake but a couple of bills are received online and he isn’t techy at all so couldn’t access them. I agree that there is a big difference between being on a couple’s pension compared with a single one. I hope our young people can learn to live frugally and it is encouraging to see some of them going down that track.

ReplyDeleteI want to share my bartering experience. There are a number of widowers in my area that know that I can sew. I take up their trousers, sew on buttons and mend tears for them. They 'pay' me in fresh caught, cleaned and filleted fish. I feel like I am the winner in this barter. This to me is more than just bartering. It is a sharing of skills that are exchanged. I have the skill to sew and they have the skill of fishing. Sharing skills is another way of saving money.

ReplyDeleteOh yes times are going to get hard. I'm greatful I negotiated with our power company and locked in a rate for two years. I'm sorry Hanno's care cost so much. I had to step in when my folks got unwell - became enduring power of attorney and sorted out all their finances and medical needs. A really hard time. Take care you You. Love leanne NZ

ReplyDeleteStill full of good advice Rhonda, thank you. I stated changing my budget. I have always acted as if I earned €100 less on my salary and that of my husband, and I continue now that we are retired, it allows me to save them.

ReplyDeleteRegarding the shopping budget, I have totaled the expenses for the last six months , and I removed 20% of this sum.

I decided to put this sum every week in an envelope and pay in cash.

I am lucky to be the age that I am (65 years old) and I knew a time when we had less comfort, and where we had to pay attention to expenses.

I hope to be able to teach it to my children and my grandchildren.

I hope my translation is correct (thanks google)

Great ideas, Pat. Thanks for sharing.

DeleteGreat advice as always Rhonda. It’s good to sort of get back to basics sometimes. I know i have let myself get caught up with life and meal planning in particular hasn’t been happening and so there’s been more ”ugh what are we going to eat? ” moments and not optimal meals or resource use than i would have liked.

ReplyDeleteOne question though. Have you ever had problems with your homemade laundry detergent? Either nit cleaning enough, smelling off or damaging your clothes or washer? Because i keep coming across conflicting info on the subject and while i absolutly want to use green homemade laundry, i am scared to ruin my machine and i can’t afford to change it.

Thank you!

If I had to change my washing machine now it would create a problem for me too. I've never had a problem with homemade laundry liquid, or the powder. A couple of years ago the washing machine stopped working - a sock blockage 😧, and the repairman asked me what detergent I used. Immediately I thought - oh no, here we go! But no, when I told him I used homemade liquid, he said it was the cleanest machine he'd ever seen. I gave him the recipe. There are three ingredients - plus water. If you look at the commercial liquids, you need a science degree and 5 minutes to read the ingredients label. Give it a go. I think you'll be surprised. xx

DeleteRonda, I always enjoy reading your posts. I'm mindful of waste, but I feel inspired to do even more. One thing that helps me: several years ago I bought a solar oven. Here in hot & humid Texas I cook outside with it. (a LOT!) Today I baked a couple of loaves of sandwich bread, yesterday I baked apple bread using apples from my aunt's apple tree to use as a hostess gift, and the day before that I baked sweet potato brownies for a dinner party. Thank you for sharing the days of your life with us! ~TxH~

ReplyDeleteA wonderful post Rhonda! If we all had the benefit of hindsight, life would look very different, but I think we all do the best we can at the time. You would certainly have had enough concerns managing your new life with Hanno becoming so unwell and needing your assistance in so many ways, emotionally and physically, without having to be mindful of managing the finances also. The bills have a way of reminding us that they are there and need attending to! I hope you are feeling in control of the finances now. Your tips have been a godsend to many and are very relevant now, as they have been in generations past. I am looking forward to moving home and being able to re-establish a vegetable garden. Ours has been sitting idle as we knew we had to move, and our slow to start growing season made growing our own the past few months untenable. It has resulted in a noticeable increase in our shopping trips. Who knew the humble silverbeet was so expensive! Take care Rhonda and enjoy all the fruits of your hard earned labour xx

ReplyDeleteThanks Paula. Good luck with your move. xx

DeleteAlways love reading your notes. We have been trying to declutter as well. On the financial side, I go through all our outgoings each year and revisit them all. I am pleased that I did the mortgage last year, as I was able to negotiate my interest rate down by almost half and fix it for two years. Very happy I did.

ReplyDeleteThank you again Rhonda for your tips. I think one of my favourite pass times is finding more ways to save, make from scratch or reorganise. Each year I go through al our expenses and check to see if I can improve on our outgoing costs. Saved thousands on home loan interest last year just by doing this.

ReplyDeleteYour photos are always images of the life I hope to achieve.

It's doing virtually all these things that has gotten us to be in the position we are today, with our mortgages paid off, debt free and able to live a good but simple life. You have given some good advice there for anyone who is on the first steps of sorting out their finances for these tough times that we are facing all over the world.

ReplyDeleteOh, Rhonda, I'm sorry that happened after Hanno died. How upsetting. I just straightened out the registration on my dad's car today. I bought it from my brothers after he died, but didn't realize that I needed to go to the DMV and change the title. My brother had said that he did it online. Anyway, it cost me $1,300. today in late fees. Ugh. They were closed during Covid, and then I forgot about it. An expensive mistake, but I got the car for an excellent price. Love all your tips and reminders. I love living in walkable town. I bike everywhere. Being in the mountains is so much cooler, so I don't need to run the air conditioning. At night I am starting to light a fire in the fireplace with the cast iron insert. Wood heat is so lovely...

ReplyDeleteRhonda, thank you so much for this post. Your honesty and authenticity makes what you have to say even more powerful. Some wonderful tips and reminders here for how to save money. I totally concur with reviewing yearly bills - I save $100s this year on house insurance which we had just kept running with the same company for years! Times are changing and building individual and household resilience is a must.

ReplyDeleteDear Rhonda, thank you for all you do. I’ve been reading since my children were little, now they are mid to late teens. My youngest was diagnosed with a life long health condition during the first covid lockdown & various other life changes over the last 5 years have meant I’m on my own bringing the family up now. I was particularly anxious today about finances and I’m just so glad I read your blog because I don’t feel so alone. The outgoings are huge & the income small but I listed all the things I can do for free & then walked the dog with a friend & felt much better. The worst thing is that friends, family & work colleagues all assume we have a good income like them (possibly I don’t know). I can’t really say anything as what can anyone do & it would only make them feel sorry for me. It feels quite lonely sometimes. I think the psychological impact of scraping through is tough.

ReplyDeleteI'm. sorry to read your news, dear. Hang in there and try to work out who would be the best person to talk to in your family. Family is there to help in times like these. That doesn't mean they feel sorry for you or help financially but having someone to talk to would help your mental health. I send you my best wishes and love. xx

DeleteThank you for your kind words. I was so sorry to read about Hanno - I send my love to you. I lost my lovely Dad in June - he was a true family man, full of ‘the crack’ (he was Irish) & a hard worker - you’d have loved him. He really knew poverty as a child so I need to think of that & those in real poverty now & stop bleating, we have plenty. This is just another season. Thank you though, I cried when I read your reply but now shoulders back & onwards.

ReplyDeleteThank you again for continuing to offer direction and insight for living in today's world. It has been a struggle for so many. I certainly appreciate the fact you do NOT charge for viewing your sight, helping others with your kindness it a gift to so many.

ReplyDeleteI think of the 5, 10, 15 minute guide I adopted many years ago while quilting. It is surprising what a person can accomplish in just a few minutes at a time. I use this in cleaning, crafting, sewing, cooking etc. Just a few minutes can make a job seem less overwhelming and more rewarding. While a meal is cooking, I can be clearing off a counter, sweeping the floor, organizing the refrigerator or working on a gift that I am making. I stop viewing things in a "to get finished" mode to a slower pace of accomplishment. I feel better, less stressed and enjoy life more by this approach. Just a little change, mind set and viewing the tasks in a simpler way sure helps. I also always save those little bits of veg by freezing so that I can make soups, cut up citrus for the freezer, make extra when I cook such as pancakes, breakfast burritos, anything that can sure time and expense for later. If you use plastic bags wash them and reuse (no meat storage previous).

Teaching generations how to live within their means is one of the greatest gift one can receive. I learned so much from my mom.

If I’m looking for new clothing I often go to the Salvos online shop and local pre loved stores. Have found some real bargains there. Recently bought a pair of Revere sandals for $17.50 which retail for $189. Currently looking for a dress to wear to my sisters wedding next year.

ReplyDeleteHi Rhonda, may I first say that I have read all your books and absolutely loved them. You're like a wise grandma that I never had, showing me how to run a home. Thank you so much! I'd like to ask about your garden beds. I noticed that the borders are made with bricks. Could you please tell me if the bricks are fixed to the ground in any way? It may be a much cheaper alternative to raised beds which cost a fortune! Regards, Weronika

ReplyDeleteHello Weronika. Thank you. Yes, they're large bricks called Besser blocks. They're set into the ground about an inch or two deep and become quite stable in the ground. They don't need any cement or anything else to place them in the ground. Just pack the soil in around them and they'll be fine. They're easy to move as well if you rearrange your garden over the years. Look on Gumtree as people often want to get rid of bricks and Besser blocks on there and they might be free as long as you go and pick them up. Good luck with your gardens. xx

DeleteDear Rhonda, I seem to no longer receive your wonderful blog, I thought perhaps you were taking a break after your sad loss. I can’t seem to find where to subscribe. I really miss hearing from you and have followed you for a long time and would love to continue doing so. Could you please let me know via these comments how I can reconnect. With warmest regards, Carol

ReplyDeleteI welcome readers' comments. However, this blog never publishes business links or advertisements. If you're operating a business and want to leave your link here, I will delete your comment .