So far we've changed our mindset, or are working on it, we're tracking our spending, or starting to, and before we write up a budget, let's look at ways to save money. The obvious things are selling what you no longer need, making sure you don't waste anything, changing service plans or not paying for things you may be able to do without, such as:

- a second car;

- the premium data package on your phone and internet instead of something more prudent;

- cutting back on your children's after-school activities;

- cutting back on family outings that cost money and make it a once a month event instead of weekly.

Hanno and I did all that many years ago. We sold our second car, got rid of pay TV and then I started learning how to stockpile, make bread, soap and cleaning products. I changed the way I cleaned, went back to cooking from scratch and got rid of most of the harmful chemicals I had in the house. With everyone of those changes we paid out less money. I started decluttering and getting rid of years of excess and while I'll never be a minimalist, we live with a lot less junk now, and it makes a delightful difference. With ebay and gumtree, it's quite easy to sell what you don't want and if you do that, set that money aside to pay down your debt.

Cutting up an old sheet to use as cleaning rags.

I got into the habit of knitting dishcloths that can be washed and reused many times, I now mend torn clothes and dropped hems, I sew buttons back on and replace zippers. I have a sewing basket where all items that need help are collected and when there are a few things in the basket, I set aside some time to mend them. What a money saver that is and it's a pleasant way to spend time, hand sewing, darning and sewing on buttons. I now cut up old sheets and use them as cleaning rags and between those rags and my knitted dish cloths, I don't buy any cleaning cloths at all. With a bit of thought, you can change how you work in your home and it will save you a lot of money.

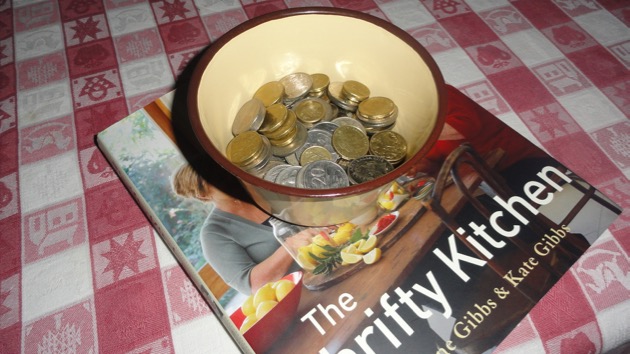

Another thing that's useful for many people is to stockpile groceries. Buying food that you know will keep well in a cupboard, or preserving fresh food when it's in season, will help you save. It also gives you a good backup if there is a community emergency, if you or your spouse lose your job or if you get sick and can't get to the shop. Having that little cupboard full of healthy food will save the day as well as money when you least expect it to.

We've had a solar hot water system for over 30 years. According to the stats, in an average home hot water costs about 30 percent of the electricity bill, so it's a big help if you can afford to install solar. Generally a solar system for hot water, or solar panels for more general use, will pay for itself in a few years, so if you have some spare money, using solar power is a great investment.

You only need a small garden to grow salad leaves, tomatoes and herbs. If you can do that, it will save you money and you'll get far healthier produce.

If you don't have solar, it will be important for you to look for ways to cut down on your electricity usage. We've been able to cut down our usage and we use a fraction of what is normal now. There are two of us here, with frequent visitors, and we use the same amount of electricity as one person. That has been consistent over the past ten years. If you're going to try to cut your bill, everyone in the house will have to work towards that goal so have a talk with your family and work out ways to work together to cut down. That's particularly important if you share your home with teenagers or young adults.

Here is a list from an old post, written in 2011, that might give you more ideas about cutting back.

- Spend less than you earn. Not just today and this week, but all the time.

- Spend only on needs, not wants.

- Make up a workable and realistic budget and stick to it.

- Stockpile food and groceries - this is your insurance policy that even if the worst happens, you'll still be able to feed the family.

- If you have to find some money you don't have to pay bills cut out unnecessary expenses like internet, mobile phone, cable TV, magazines, coffee at the cafe etc.

- Cook from scratch.

- Never waste food, eat your leftovers and have a couple of meatless meals every week.

- Take lunch and a drink to work and school.

- Monitor your electricity, water and gas useage. Learn how to read your meters.

- When you're cooking on the stove top, bring the food to the boil with the lid on, then turn the power down to a simmer. Leaving the gas or electricity on full will waste it.

- Turn off lights and TV when you leave the room.

- Turn off stand by appliances when you're not using them and when you go to bed.

- Stop buying cleaning products and make your own using bicarb and vinegar.

- Make your own laundry liquid. There is a recipe for it here.

- If you haven't already done it, think about putting in a vegetable garden. If you've already got one, think about adding fruit and herbs.

- If you have no space to grow vegetables, buy your fruit, vegetables, eggs and honey at a local market. The prices will probably be cheaper than the supermarket.

- Check out your local butcher shop. The prices will probably be lower than the supermarkets and the quality of meat better. (We bought lamb on special at one of the big supermarkets last week and the quality of it was vastly inferior to what we usually get from our local butcher. Lesson learned.)

- Teach yourself to knit and sew. There are many sites on the internet with very good instructions, tutorials and sometimes, videos. Try MADE, Instructables, Knitting Help.

- Make your home the kind of place you want to spend time in. Invite friends around instead of going out for coffee or drinks.

- Self reliance and a thrifty mindset will help you get through most things. Start with one thing, then move on to the others when you're ready.

There are so many individual things that we could give up or cut down on but it is up to everyone to work out what they are and then commit to doing it. One thing I do want to remind you of is this: these are YOUR decisions to make, not mine, not your best friend's, only yours and you family's. Think about your life and what you can achieve by make these small changes. I'm not saying it will be easy because it's not, but it does get easier. If you can do this and use your savings to pay off debt or save, it might change your life. Good luck, my friends. I hope you dive right into this.

I hope you have the time to add your comments about what you're doing and what works for you. What you say here may be just the thing someone needs to read. xx

More reading:

.jpeg)

.jpeg)

.jpeg)

.jpeg)