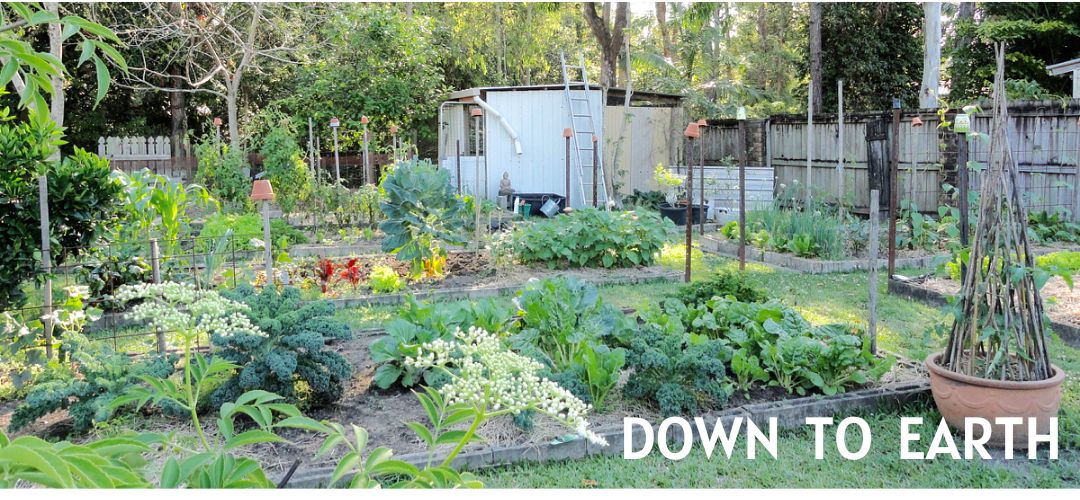

Our six monthly water bill arrived yesterday. It was $44.85, with our discount we have to pay $40.36. We've worked hard to reduce our water consumption and as the price of water has been rising - from 78 cents/kilolitre in 2002 when our bill was $248.20; 78 cents in 2004 when our bill was $148.20; 95 cents/kl in 2006 when our bill was $101.65 to 115 cents/kl now when our bill is $44.85, we have been using less and getting the most out of every drop. We've done a similar thing with our electricity bill.

There are choices to be made when you decide to live simply and reduce your impact on the world. One of the choices we made was that reducing our use of water and electricity was something we could achieve that would make a different to our greenhouse gas emissions and to the amount we paid for our utilities. We worked on one thing but got two rewards for the work we put in. In many ways being frugal is being green.

We did a similar thing when we decided to get rid of our debt. We paid off our house in eight years. We did that by first making the conscious decision to do it, we made a plan on how we'd do it, then we did it. That last part was the most difficult. ; ) It's easy looking at something and knowing you need to work on it; making a plan is pretty easy too, but the doing of it. Well, that takes effort, perseverance and determination.

One of the things we planned for when we started on this path of debt reduction was to not worry about what our family, friends and neighbours thought. We had to have enough confidence to know, really know right down to our bones, that what we were doing was right for us. It might not have been right for our neighbours, or our friends, but for us, it was right - it would make our lives better. I'm not going to tell you it was easy, because sometimes it wasn't, but as we got into it and we saw our debt reducing every week, instead of going up or stagnating, it replaced the feelings of deprivation we sometimes felt when we decided against buying tickets for a concert, going out to dinner or going on holiday, with something better - we felt the taste of freedom.

Being in debt restricts you. It makes you play by someone else's rules. You have to work enough so you have the money to pay up every month. And the really horrible thing about having a mortgage or credit card debt is that often when you make a payment, you don't reduce the debt - or you only reduce it by a small fraction - often you're just paying interest to a bank.

But the purpose of this post is not to remind you of your mortgage or credit card bills, but to show you, by example, that reducing debt isn't just about your large bills. You can reduce your debt by cutting back on your consumption of water, electricity, gas, petrol and your phone. When you pay less for all these things, not only will you reduce your footprint on the earth, you'll also have more money to pay off your mortgage and credit cards. And, ladies and gentlemen, I guarantee that the day you pay off your mortgage will be a day you'll remember for a long time. There is such a feeling of relief and freedom that you'll be smiling all the way to the bank to finalise your account.

Tomorrow I'll write about ways to pay off debt.

There are choices to be made when you decide to live simply and reduce your impact on the world. One of the choices we made was that reducing our use of water and electricity was something we could achieve that would make a different to our greenhouse gas emissions and to the amount we paid for our utilities. We worked on one thing but got two rewards for the work we put in. In many ways being frugal is being green.

We did a similar thing when we decided to get rid of our debt. We paid off our house in eight years. We did that by first making the conscious decision to do it, we made a plan on how we'd do it, then we did it. That last part was the most difficult. ; ) It's easy looking at something and knowing you need to work on it; making a plan is pretty easy too, but the doing of it. Well, that takes effort, perseverance and determination.

One of the things we planned for when we started on this path of debt reduction was to not worry about what our family, friends and neighbours thought. We had to have enough confidence to know, really know right down to our bones, that what we were doing was right for us. It might not have been right for our neighbours, or our friends, but for us, it was right - it would make our lives better. I'm not going to tell you it was easy, because sometimes it wasn't, but as we got into it and we saw our debt reducing every week, instead of going up or stagnating, it replaced the feelings of deprivation we sometimes felt when we decided against buying tickets for a concert, going out to dinner or going on holiday, with something better - we felt the taste of freedom.

Being in debt restricts you. It makes you play by someone else's rules. You have to work enough so you have the money to pay up every month. And the really horrible thing about having a mortgage or credit card debt is that often when you make a payment, you don't reduce the debt - or you only reduce it by a small fraction - often you're just paying interest to a bank.

But the purpose of this post is not to remind you of your mortgage or credit card bills, but to show you, by example, that reducing debt isn't just about your large bills. You can reduce your debt by cutting back on your consumption of water, electricity, gas, petrol and your phone. When you pay less for all these things, not only will you reduce your footprint on the earth, you'll also have more money to pay off your mortgage and credit cards. And, ladies and gentlemen, I guarantee that the day you pay off your mortgage will be a day you'll remember for a long time. There is such a feeling of relief and freedom that you'll be smiling all the way to the bank to finalise your account.

Tomorrow I'll write about ways to pay off debt.

Graphic from allposters.com