This week I'll be answering the questions asked by readers last week. The first is on retirement.

This week I'll be answering the questions asked by readers last week. The first is on retirement.I guess we fell into retirement without thinking too much about it. Well, maybe I did that, Hanno probably didn't, he's very careful and always plans, especially when finances are involved. Nevertheless, we both found ourselves "retired" - he is well and truly over retirement age (65 years) and gets a pension, I am still under retirement age and earn a bit of money writing. We are among the first of the baby boomers, and in Australia, the laws on superannuation (401K) only came into being during the early 1990, so we didn't come to this life with a pile of cash sitting in a retirement fund. Very few early boomers have cushy little nest eggs on which to travel the world and those who do would probably have lost a lot of it during this recession, if they invested in shares or real estate. We have a few shares but they lost a lot of value in the past year and I have a small amount of superannuation cash waiting for me when I turn 65.

I have never believed that we needed anywhere near what financial planners say you need - it's something like $500,000 per person! We live on less than $25,000 a year and pensions well and truly cover that. Of course, it depends on how well your own country provides for its elders ,but it also relies on debt - if you do have debt, it would be very difficult to retire on a small amount. We are lucky and paid off all our debt many years ago, we own our home and we're in good health. Health plays a part too, and we have kept our private health insurance - that is covered in our $25,000 a year. We do have free medical and hospital care in my country but it's slow, you go on waiting lists, and we want the comfort of knowing we can have the best of health care if either one of us is ill. But I don't want to make this post solely about money, because if you live as we do, while money is important, it's not the most important thing.

And please note, I am not a financial adviser, have never worked in any industry connected with banking or investments and I'm merely relaying our circumstances to you so you can understand our retirement, and maybe work on your own plans.

If you plan on a simpler lifestyle when you retire, yes, pay off debt first and put away some money, but above all else, develop a set of skills that will help you live the way you want to live. Learn to cook from scratch, learn how to bake, sew and mend, Work out what you'll do with an over abundance of vegetables - will you freeze or preserve/can? While you're still working, buy the tools and appliances you'll need to do all those daily and seasonal tasks.

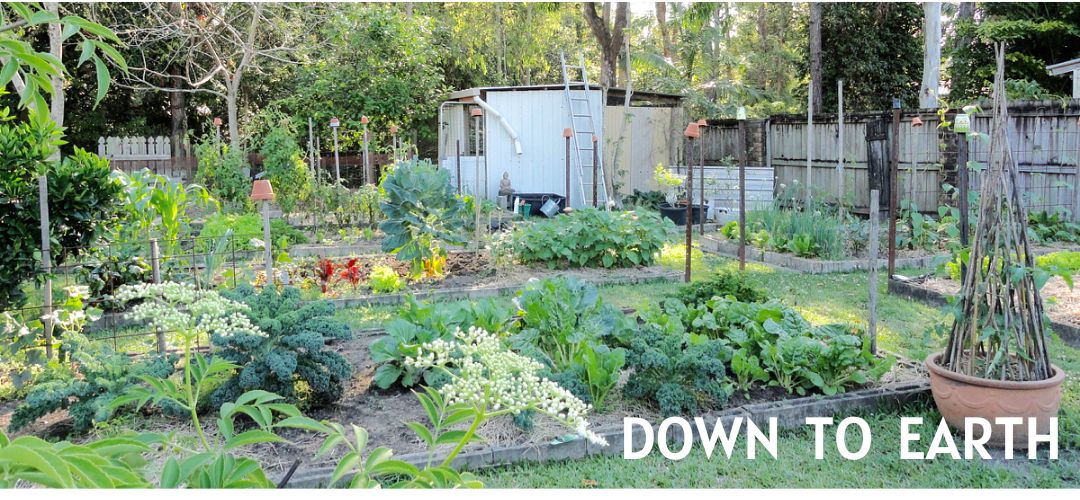

Look critically at your home, will it support you in retirement? You'll have a lot more time to work at home - time to produce food in the backyard, raise chickens for eggs or meat, harvest honey from bee hives. Will you be able to do those things where you are now? Do you know how to sew, knit and mend? If you answered no, now is the time to learn. What about home maintenance and supporting your lifestyle with home servicing? Doing your own will save a lot of money. Learn how to unblock drainpipes, change the oil on the car, service the lawn mower, and clear the guttering on the roof. These activities will not only save you money, they'll fill your hours, keep you fit and active and give you purpose. Instead of working for a living, you'll be working for your life.

Get used to not buying clothes and shoes every year - fashion is overrated anyway. Develop your own style that is plain and simple and be proud that you've stared down the fashion police. If you don't already do it, buy the best quality you can afford and products that can be repaired. You want things to last as long as possible so look for value for money instead of the cheapest price. If you are both working, see if you can live on one income now, and save the other income for buying water tanks, solar panels or a reliable, and cheap to run, car.

I encourage you to do all these things and also to think about your life and what will make you happy. Living simply is a lot of work and as long as you go in knowing and embracing that you can't go far wrong. You will be disappointed however, if you think this life we live is easy. It's satisfying, enjoyable, rewarding and wonderful but it's not always easy. You have to really know that.

But if you want to feel content with life and proud of what you do for yourself, if you want to take your life by the collar and give it a good shake, then this is the life for you. We can do whatever we feel like doing most days, we have the satisfaction of growing some of our own food, eating healthy food, taking each day slowly and we grow confident knowing we can look after ourselves, even if a major disaster occurred. We have grown closer to our own lives, we provide the raw materials for many of the things we need, we aren't passive bystanders any more.

I guess our example shows that if you have no debt, own your own home, have the space to grow some food and the knowledge to put some of that food up for later in the year, if you can conserve rather than spend and be happy doing that, then this kind of retirement may suit you too. It's probably the opposite to what a mainstream retirement is - whereby you save and invest as much as possible so you can stop work, relax and travel. We look forward to the work we do now, because the work helps give purpose to each day.

So if you are looking for a retirement that keeps you busy, entertained and thoughtful, if you want to feel in control of your life, if you are prepared to do simple honest work for the rest of your life, then start preparing for it now - in developing your skill set that will deliver to you a life like no other. I am here to show you it is possible, the hard bit is up to you - are you ready for it?

Hi Rhonda,

ReplyDeleteAnother great post. Very timely for my family, I'm retired, and like you well under the retirement age to collect social security, and my hubby will retire in January. We've always tried to be self sufficient and do most jobs around the house ourselves. But lately I've been feeling like I'm not doing enough frugal/simple things...I need to sit down and review and see where I can improve. Your posts from last week were very helpful. Keep up the good work. I look forward to reading your posts everyday!!!

Coleen

PS Hope all this made sense!!!!!

hi rhonda,

ReplyDeletethank you so much for writing that. it is just what i needed to get me in focus. i think my main concerns about retirement is the way our country is heading (new zealand) it seems there is going to be less and less in the way of government superanuation for my generation, but on the bright side, i can do all the things you mentioned in your post and am doing them all pretty much already. but there is always room for improvement. i guess our task right now to prepare for retirement is to get rid of all our debt. i think that is a biggie. just a word of advice to younger people. we have found that our living on credit has caught up with us. things like credit card debt, a little mortgage on the house here and there. i am not complaining but now that we have hit the end of the road we have to buckle down and pay that debt back. oh well, forward we go. once again. thank you. i love your blog. like coleen i hope this all makes sense too!!

sophie in new zealand

Thanks Rhonda!

ReplyDeleteI'm nowhere near retirement age (I'm 29, lol!), but it's nice to be reassured that I will be able to manage with the skills I'm gaining and using now :)

I do try to put into practice the principles you write about these days too though, working to live, putting effort into being at home, eating, decorating, entertaining, making, mending... Between us, we can pretty much mend (or at least botch!) most things in the house. And I'm working on being able to do the same thing with our van...

Our garden is small, but we're learning to grow some things that are expensive in the shops, such as fresh herbs and soft fruit. Not enough to live on! But a good contribution :)

Thanks again for your encouragement to watch the pennies, love our homes, and be deliberate in all we do :)

And good luck with your writing still, I assume it's still going well? I have ten weeks to go before my PhD is submitted, and I think of you beavering away as I write!

best wishes,

Jenni

Rhonda, I just checked out your journal. and I am very impressed. I am retired I live alone, and I also like the simple life. But unfortunately I am not all that self sufficient. I try to read a new blog every day. Yours is so interesting, I will be back to check the updates.

ReplyDeleteHi Coleen and Sophie, it makes perfect sense to me. Thanks to you both for sharing your story.

ReplyDeleteJenni, you're doing well, don't give up. Yes, I'm still writing and it's going well. I sent the final book proposal to New York yesterday. Fingers crossed. Good luck with your PhD, the last bits of writing are always the most difficult - and rewarding.

Welcome Barbara.

Rhonda,

ReplyDeleteHow would you suggest a single person go about being ready? I do some of the things you have mentioned,I am debt free, freeze extra food, sew, bake, etc. I am wanting ideas from others so I am not afraid in retirement when I need to count on myself and have no bimonthly check. I am saving because I know I cannot do my job until age 65. Thank you! And love your post.

I am 45 and this post gives my husband and me sound advice on deliberately and systematically planning our retirement years, never mind if they are a couple of decades away. Truly, money is an imporatnt aspect in retirement planning, BUT it is not the only thing and as you said, not the most important. Thank you so much!

ReplyDeleteHi Rhonda, really enjoyed this post. Retirement I guess is something one can never be fully prepared for; I think and wonder about it regularly, and yet have not made any plans. I like the way you continue to live with purpose.

ReplyDeleteRhonda,

ReplyDelete"We" retired about a year ago - my husband well ready and since we moved, I stopped working all together. At first I didn't think I could not work - I was so keyed into working. But 10 months later, I am having the time of my life - sewing, quilting, baking, cooking (all from scratch), knitting, gardening. I am working hard at simplifying my tastes and my biggest joyful challenge is figuring out gifts that I can make. I have just finished most of a quilt for my daughter in law and a scarf for my husband. I am working on another scarf for one son and a quilt for the other. I take so much inspiration from you. My hardest challenge is the gardening thing. We moved to an entirely different ecosystem so lots to learn - especially when I am learning to garden from scratch. Well enough of this... LOL

Patricia

Hi Rhonda

ReplyDeleteI hope you have broad band & able to watch this episode of Country Calendar

http://tvnz.co.nz/country-calendar/episode-21-great-and-small-2829741

It is just how I want to retire - well not actually retiring - but just keep living & working where we want to & enjoy.

I think you will also enjoy the episode

Love Leanne

I'm retired, due to medical issues, although under retirement age. I went from earning close to $70,000Au a year, to being on a disabilty pension of $250 week.

ReplyDeleteFortunately, I'd always lived frugally, a spin off from growing up poor, then supporting two children on a single mum's pension while I studied. The day I was granted the pension I felt a great weight lift off, knowing I could do ok on that small amount. I have a little money in shares, but like most people's, it's been eroded.

I own my own home and car, had no debt, I had skills....cooking, sewing, gardening, and felt I'd been given a great gift to stay home and putter in my garden and sewing room, even though I have very little income. I now do a lot of knitting and sewing for charity.

I budget carefully, and allow money in that budget to pay someone to mow my lawn, and a great handyman who's also on a disability pension, he fixes all the little things I can't manage, and very reasonably.

It's worth it to me to pay someone else to do things I either physically can't manage, or have no skills in, and think it's important for people to know it's possible to live as self sufficiently as you can, and not be deterred if you don't have a handy husband, or know that some tasks are impossible for you.

Find someone you trust, someone who listens to what you want without imposing their views, and then pay for those jobs to be done....after all, it keeps the money flowing, and might allow someone else a little extras.

Nanette

Good morning Rhonda,

ReplyDeleteI really enjoyed reading this post. My husband and I are both in our late 30's, with baby number 7 due in a week. We are making some decisions now that will hopefully help us when it comes time for my man to retire. We try to eat well and look after ourselves physically - we want to be able to be fit and healthy to keep up with our grandchildren! Life is so busy now; so we just do what we can, and learn what we can, knowing that later on there will be more time. All this to say that we are realizing the decisions we make now will have an impact on our future...

Have a lovely day ...

Rebecca

Thank You again for a lovely post.

ReplyDeleteMy DH and I are in our middle fifties and have some years before retirement,I stay focused with our 5year plan, In 5 years our Mortgage will be paid off, also credit cards/debt will be a thing of our past, CASH will rule around this roost,We still need to purchase things for sustainability.Example would be to enlarge our garden area, install rain barrels,start our fruit ( blueberry) crops, etc.

You see my (career) occupation was as a bank manager and mortgage processor, yet in my heart of hearts I can't sell those products to anyone anymore. CASH is the only way to LIVE, Be mindful of your own resources, Be mindful of your needs and remember It May Be a Frugal Life~~ But It Will Be Your Life.

Blessings

Thanks so much for your wonderful blog posts Rhonda, I gain so much by reading them. Wanted to let you know that our chooks are laying again and 'fluffy' has grown a whole new set of feathers. Thanks for all of your advice about this. Our chooks are now back to normal again, in their new home.

ReplyDeleteHi Rhonda,

ReplyDeleteThere is one more thing to add I believe if you plan to live the simple life and be retired.

Live a healthy life! Get your checkups, do what it takes to be a healthy young person so you can also be a healthy retired person. The simple life is wonderful but it does require some work.

Here in the States they (the financial advisors) tell us we need $1,000,000.00 per person to retire. When I asked about those numbers and pointed out I don't spend the annual sum I would be receiving under this plan now, and I won't have debt, mortgage, etc. they were stumped, didn't know how to answer me.

ReplyDeleteI do contribute to a 401k plan, and he has an IRA. But our retirement plan is to have no debt, to live a simpler life, and to spend time with family and friends. With that plan and a conservative inflation rate we can live quite comfortably on $20,000 a year or less. So when it comes time for me to "retire" I won't so much retire as change paths to doing a hobby for some extra income.

This was a good post.

sometimes, life interferes with plans you make and all you can do is the best you can do. like you, rhonda, i live on $25,000 a year from a small retirement pension and occasional work i still do. my college age granddaughter lives with me and she also works part time. we lost our home in a natural disaster 4 years ago and now live in a small apartment in another part of the country. i do carry one major debt which has a huge monthly payment because 6 years ago, i made a choice to send my granddaughter to a specialized school with a very hefty price tag. my investment paid off as the school saved her life and she is on her way to a bright future. so, although, i live a very simple, yet enriched life, i will be in debt well into my 80's.

ReplyDeletei love reading your blog every day to learn how you enjoy your simple life.

Thank you for this post. It was insightful and realistic. I'm no where near retirement age, but this post was still very helpful.

ReplyDeleteWOW. I am so impressed by your insight and your plans.There are entire generations who can benefit from your advice, and perhaps even an open letter to K Rudd endorsing your approach!

ReplyDeleteYou have our admiration!

- Nuffnang.

Hello Rhonda and Hanno,

ReplyDeleteGreat advise. While my husband is past retirement age and collects his social security I have MANY years to go an honestly don't think the social security system here in the US will still be an option even though I have paid into it all my working life.

As you mentioned 401Ks are not reliable either. For me the only one I can count on is myself. Work hard, don't create debt and add to my savings, along with all the life skills you mentioned I hope will be enough in 25+ more years when I retire too...

This is great advise, I printed this post out and added it to my home note book!

Karyn

Hey Rhonda

ReplyDeletePart of the reason you hear financial experts say you need a huge sum of money to retire is that most of us tail end baby boomers have no pensions because jobs stopped doing that long ago.

In U.S.A. we have Social Security, which we pay into all our working lives, and they give back a small amount each month, not enough to live on no matter how frugal you are. So we need to supplement Social Security with our own retirement savings.

And then there's the rumor, for those of us born at the end of the baby boomers, that Social Security will either not be there for us (the money runs out) or it will only be 50% of what we should receive. Some pretty scary thoughts for those of us in our late 40's - early 50's.

great post about planning for retirement. Something my parents did way before they retired was to move to a smaller property and downsize their possessions ( less to maintain and clean) They then spent the last few working years really working on this house. They updated the heating and insulation ( we're in the Uk so that's important) and put in a new kitchen. So all the expensive things have been taken care of whilst they were still earning. They've made sure that the house will be manageable when they are less able

ReplyDeleteAs ever enjoying your blog

Julie

x

I started preparing for retirement some years before I quit work. The house was paid for and I made improvements to it and built up my super as much as possible. I stocked up on things like manchester, replaced kitchen appliances, cutlery, crockery (gave away 'good' stuff) saucepans etc, buying the best I could afford at sales. I cant have a vegie garden as yard is not suitable but I do all my own housepainting and furniture renos. My pension from super is in an industry fund so fees are very low and I get age pension, have private health insurance and live fairly simply. Life is good.

ReplyDeleteHi Rhonda, just wondering how your budget has increased in line with the CPI since 2009. Back then you said you were living on $25,000 p.a.

ReplyDeleteMy husband and I were both retrenched last December and at 56 & 58 years old, we have decided to retire on our Super as it's been very hard to find work. Our annual budget is $27,500 and we are managing fine, so far. It's 3/4 of the way through the year and we are still on track but we do own our own home and have solar panels which helps to keep expenses down. How